HP 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

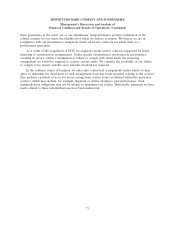

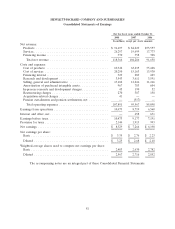

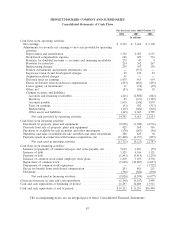

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the fiscal years ended October 31

2008 2007 2006

In millions

Cash flows from operating activities:

Net earnings ........................................... $ 8,329 $ 7,264 $ 6,198

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation and amortization ............................ 3,356 2,705 2,353

Stock-based compensation expense ......................... 606 629 536

Provision for doubtful accounts — accounts and financing receivables . 275 47 4

Provision for inventory .................................. 214 362 267

Restructuring charges ................................... 270 387 158

Pension curtailments and pension settlements, net ............... — (517) —

In-process research and development charges .................. 45 190 52

Acquisition-related charges ............................... 41 — —

Deferred taxes on earnings ............................... 1,035 415 693

Excess tax benefit from stock-based compensation ............... (293) (481) (251)

Losses (gains) on investments ............................. 11 (14) (25)

Other, net ........................................... (83) (86) 18

Changes in assets and liabilities:

Accounts and financing receivables ........................ (261) (2,808) (882)

Inventory .......................................... 89 (633) (1,109)

Accounts payable .................................... 1,630 (346) 1,879

Taxes on earnings .................................... (43) 502 (513)

Restructuring ....................................... (165) (606) (810)

Other assets and liabilities .............................. (465) 2,605 2,785

Net cash provided by operating activities .................. 14,591 9,615 11,353

Cash flows from investing activities:

Investment in property, plant and equipment .................... (2,990) (3,040) (2,536)

Proceeds from sale of property, plant and equipment .............. 425 568 556

Purchases of available-for-sale securities and other investments ....... (178) (283) (46)

Maturities and sales of available-for-sale securities and other investments . 280 425 94

Payments made in connection with business acquisitions, net ......... (11,248) (6,793) (855)

Net cash used in investing activities ...................... (13,711) (9,123) (2,787)

Cash flows from financing activities:

Issuance (repayment) of commercial paper and notes payable, net ..... 5,015 1,863 (55)

Issuance of debt ........................................ 3,121 4,106 1,121

Payment of debt ........................................ (1,843) (3,419) (1,259)

Issuance of common stock under employee stock plans ............. 1,810 3,103 2,538

Repurchase of common stock ............................... (9,620) (10,887) (6,057)

Prepayment of common stock repurchase ...................... — — (1,722)

Excess tax benefit from stock-based compensation ................ 293 481 251

Dividends ............................................. (796) (846) (894)

Net cash used in financing activities ..................... (2,020) (5,599) (6,077)

(Decrease) increase in cash and cash equivalents ................... (1,140) (5,107) 2,489

Cash and cash equivalents at beginning of period .................. 11,293 16,400 13,911

Cash and cash equivalents at end of period ....................... $10,153 $ 11,293 $16,400

The accompanying notes are an integral part of these Consolidated Financial Statements.

83