HP 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

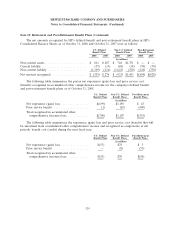

Notes to Consolidated Financial Statements (Continued)

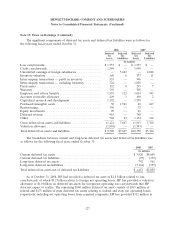

Note 13: Taxes on Earnings (Continued)

In October 2008, the Emergency Economic Stabilization Act of 2008 was signed into law, which

included a retroactive two year extension of the research and development tax credit from January 1,

2008 through December 31, 2009. The retroactive income tax benefit of $45 million was recorded in

HP’s financial statements in the fourth quarter of fiscal 2008.

In fiscal 2007, HP recorded $80 million of net income tax benefit related to items unique to the

year. The recorded amounts consisted of income tax benefits for valuation allowance reversals of

$154 million attributable to deferred tax assets for state tax credits and $60 million attributable to

deferred tax assets for foreign net operating losses, offset by a $96 million net increase to various tax

reserves, a net tax charge of $18 million for the adjustment to estimated fiscal 2006 tax accruals upon

filing the 2006 U.S. federal and state income tax returns, and a net tax charge of $20 million for other

items.

In fiscal 2006, HP recorded $599 million of net income tax benefit related to items unique to the

year. The recorded amounts included net favorable tax adjustments of $565 million to income tax

accruals as a result of the settlement of the Internal Revenue Service (‘‘IRS’’) examinations of HP’s

U.S. income tax returns for fiscal years 1993 to 1998. The reductions to the net income tax accruals for

these years related primarily to the resolution of issues with respect to Puerto Rico manufacturing tax

incentives and export tax incentives, and other issues involving our non-U.S. operations.

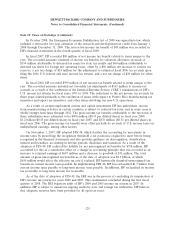

As a result of certain employment actions and capital investments HP has undertaken, income

from manufacturing activities in certain countries is subject to reduced tax rates, and in some cases is

wholly exempt from taxes through 2022. The gross income tax benefits attributable to the tax status of

these subsidiaries were estimated to be $900 million ($0.35 per diluted share) in fiscal year 2008,

$1.2 billion ($0.43 per diluted share) in fiscal year 2007, and $876 million ($0.31 per diluted share) in

fiscal year 2006. The gross income tax benefits were offset partially by accruals of U.S. income taxes on

undistributed earnings, among other factors.

On November 1, 2007, HP adopted FIN 48, which clarifies the accounting for uncertainty in

income taxes by prescribing the recognition threshold a tax position is required to meet before being

recognized in the financial statements and also provides guidance on derecognition, classification,

interest and penalties, accounting in interim periods, disclosure and transition. As a result of the

adoption of FIN 48, HP reduced the liability for net unrecognized tax benefits by $718 million. HP

accounted for this as a cumulative effect of a change in accounting principle that was recorded as an

increase to retained earnings of $687 million and a decrease to goodwill of $31 million. The total

amount of gross unrecognized tax benefits as of the date of adoption was $2.3 billion, of which

$650 million would affect the effective tax rate if realized. HP historically classified unrecognized tax

benefits in current income taxes payable. In implementing FIN 48, HP has reclassified $1.3 billion from

current income taxes payable to long-term income taxes payable. In addition, HP reclassified its income

tax receivable to long-term income tax receivable.

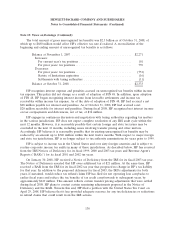

As of the date of adoption of FIN 48, the IRS was in the process of concluding its examination of

HP’s income tax returns for years 2002 and 2003. This examination concluded during the first fiscal

quarter of 2008. The IRS began an audit of HP’s 2004 and 2005 income tax returns in 2007. In

addition, HP is subject to numerous ongoing audits by state and foreign tax authorities. HP believes

that adequate reserves have been provided for all open tax years.

129