HP 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

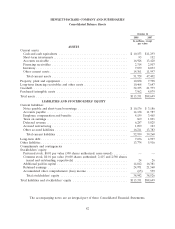

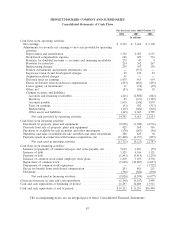

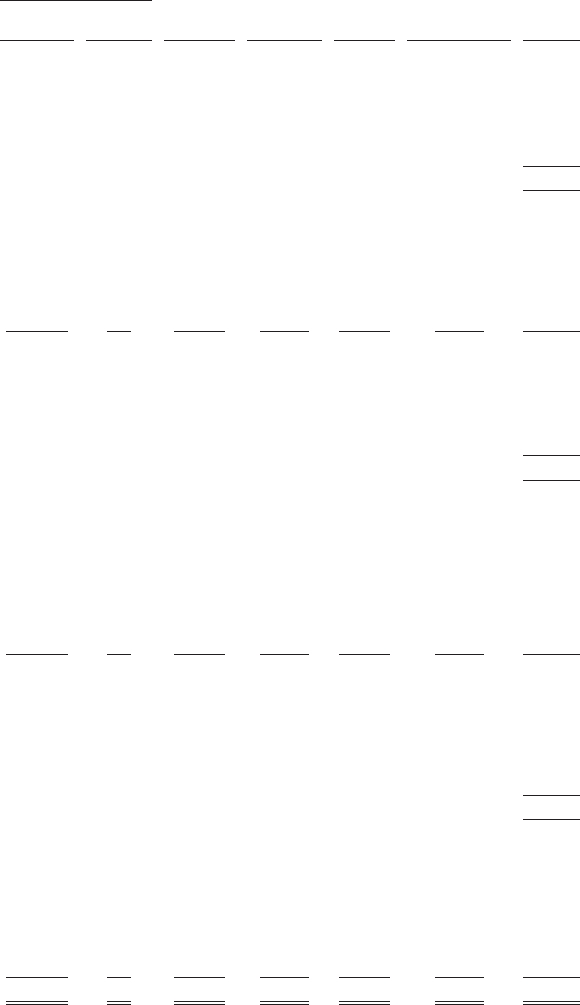

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity

Accumulated

Common Stock Additional Prepaid Other

Number of Paid-in stock Retained Comprehensive

Shares Par Value Capital repurchase Earnings (Loss) income Total

In millions, except number of shares in thousands

Balance October 31, 2005 ............. 2,837,196 $28 $20,490 $ — $16,679 $ (21) $ 37,176

Net earnings .................... 6,198 6,198

Net unrealized loss on available-for-sale

securities ................... (6) (6)

Minimum pension liability .......... (9) (9)

Cumulative translation adjustment ..... 54 54

Comprehensive income ............. 6,237

Issuance of common stock in connection

with employee stock plans and other . . . 117,720 1 2,487 2,488

Prepaid stock repurchase ............ (1,722) (1,722)

Repurchases of common stock ......... (222,882) (2) (5,903) 1,126 (1,254) (6,033)

Tax benefit from employee stock plans .... 356 356

Dividends ...................... (894) (894)

Stock-based compensation expense under

SFAS 123R ................... 536 536

Balance October 31, 2006 ............. 2,732,034 $27 $17,966 $ (596) $20,729 $ 18 $ 38,144

Net earnings .................... 7,264 7,264

Net unrealized loss on available-for-sale

securities ................... (12) (12)

Net unrealized loss on cash flow hedges . (18) (18)

Minimum pension liability .......... (3) (3)

Cumulative translation adjustment ..... 106 106

Comprehensive income ............. 7,337

Issuance of common stock in connection

with employee stock plans and other . . . 116,661 1 3,134 3,135

Repurchases of common stock ......... (268,981) (2) (5,878) 596 (5,587) (10,871)

Tax benefit from employee stock plans .... 530 530

Dividends ...................... (846) (846)

Stock-based compensation expense under

SFAS 123R ................... 629 629

Adjustment to accumulated other

comprehensive income upon adoption of

SFAS 158 .................... 468 468

Balance October 31, 2007 ............. 2,579,714 $26 $16,381 $ — $21,560 $ 559 $ 38,526

Net earnings .................... 8,329 8,329

Net unrealized loss on available-for-sale

securities ................... (16) (16)

Net unrealized gain on cash flow hedges . 866 866

Unrealized components of defined benefit

pension plans ................ (538) (538)

Cumulative translation adjustment ..... (936) (936)

Comprehensive income ............. 7,705

Issuance of common stock in connection

with employee stock plans and other . . . 65,235 2,034 2,034

Repurchases of common stock ......... (229,646) (2) (5,325) (4,809) (10,136)

Tax benefit from employee stock plans .... 316 316

Dividends ...................... (796) (796)

Stock-based compensation expense under

SFAS 123R ................... 606 606

Adjustment to accumulated retained

earnings upon adoption of FIN 48 ..... 687 687

Balance October 31, 2008 ............. 2,415,303 $24 $14,012 $ — $24,971 $ (65) $ 38,942

The accompanying notes are an integral part of these Consolidated Financial Statements.

84