HP 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 14: Stockholders’ Equity (Continued)

Comprehensive Income

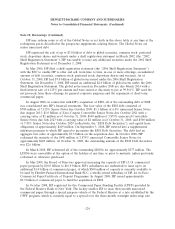

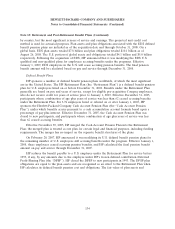

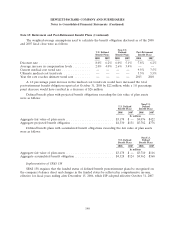

The changes in the components of other comprehensive income, net of taxes, were as follows for

the following fiscal years ended October 31:

2008 2007 2006

In millions

Net earnings .............................................. $8,329 $7,264 $6,198

Increase/(decrease) in unrealized gain/loss on available-for-sale securities:

(Decrease)/increase in net unrealized gain/loss, net of tax benefit of $7 in

2008, net of tax of $2 in 2007 and of $3 in 2006 ................. (17) 2 7

Net unrealized gain/loss reclassified into earnings, with no tax effect in

2008, net of tax benefit of $7 in 2007 and $9 in 2006 .............. 1 (14) (13)

(16) (12) (6)

Increase/(decrease) in unrealized gain/loss on cash flow hedges:

Increase/(decrease) in net unrealized gain/loss, net of tax of $468 in 2008,

net of tax benefit of $37 in 2007 and $24 in 2006 ................ 808 (63) (41)

Net unrealized gain/loss reclassified into earnings, net of tax of $34 in

2008, $26 in 2007 and $24 in 2006 ........................... 58 45 41

866 (18) —

(Decrease)/increase in cumulative translation adjustment, net of tax benefit

of $476 in 2008, net of tax of $37 in 2007 and $40 in 2006 ........... (936) 106 54

(Decrease)/increase in unrealized components of defined benefit pension

plans, net of tax benefit of $42 in 2008, $1 in 2007 and tax of $1 in 2006 . (538) (3) (9)

Comprehensive income ...................................... $7,705 $7,337 $6,237

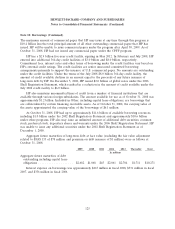

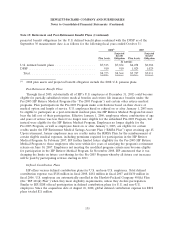

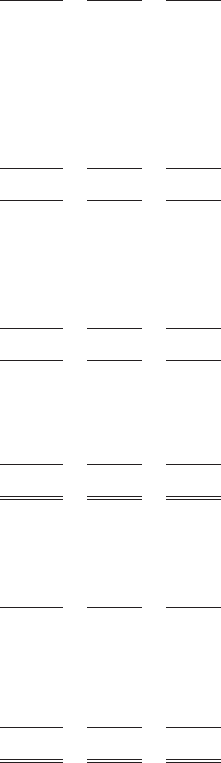

The components of accumulated other comprehensive income, net of taxes, were as follows for the

following fiscal years ended October 31:

2008 2007 2006

In millions

Net unrealized (loss)/gain on available-for-sale securities .............. $ (12) $ 4 $ 16

Net unrealized gain/(loss) on cash flow hedges ...................... 802 (64) (46)

Cumulative translation adjustment .............................. (763) 173 67

Unrealized components of defined benefit pension plans .............. (92) 446 (19)

Accumulated other comprehensive (loss)/income .................... $ (65) $ 559 $ 18

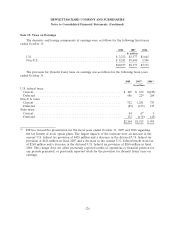

Note 15: Retirement and Post-Retirement Benefit Plans

Acquisition of EDS

On August 26, 2008, EDS became a wholly owned subsidiary of HP. EDS sponsors qualified and

non-qualified defined benefit pension plans covering substantially all of its employees. The majority of

the EDS defined benefit pension plans are noncontributory. In most plans, employees become fully

vested upon attaining two to five years of service, and benefits are based on many factors, which differ

133