HP 2008 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

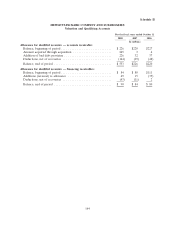

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

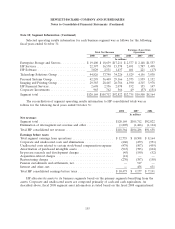

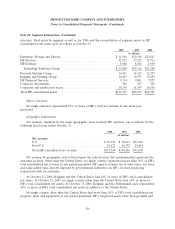

Note 18: Segment Information (Continued)

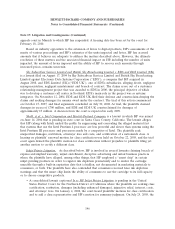

Selected operating results information for each business segment was as follows for the following

fiscal years ended October 31:

Earnings (Loss) from

Total Net Revenue Operations

2008 2007 2006 2008 2007 2006

In millions

Enterprise Storage and Servers .............. $ 19,400 $ 18,639 $17,211 $ 2,577 $ 2,148 $1,557

HP Services ............................ 22,397 16,570 15,578 2,491 1,787 1,498

HP Software ........................... 3,029 2,531 1,437 461 221 (17)

Technology Solutions Group ................ 44,826 37,740 34,226 5,529 4,156 3,038

Personal Systems Group ................... 42,295 36,409 29,166 2,375 1,939 1,152

Imaging and Printing Group ................ 29,385 28,465 26,786 4,590 4,315 3,978

HP Financial Services ..................... 2,698 2,336 2,078 192 155 147

Corporate Investments .................... 965 762 566 49 (57) (151)

Segment total .......................... $120,169 $105,712 $92,822 $12,735 $10,508 $8,164

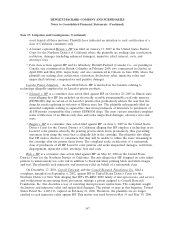

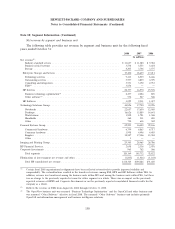

The reconciliation of segment operating results information to HP consolidated totals was as

follows for the following fiscal years ended October 31:

2008 2007 2006

In millions

Net revenue:

Segment total .......................................... $120,169 $105,712 $92,822

Elimination of intersegment net revenue and other ............... (1,805) (1,426) (1,164)

Total HP consolidated net revenue ........................... $118,364 $104,286 $91,658

Earnings before taxes:

Total segment earnings from operations ....................... $ 12,735 $ 10,508 $ 8,164

Corporate and unallocated costs and eliminations ................ (460) (439) (331)

Unallocated costs related to certain stock-based compensation expense (479) (507) (459)

Amortization of purchased intangible assets .................... (967) (783) (604)

In-process research and development charges ................... (45) (190) (52)

Acquisition-related charges ................................ (41) — —

Restructuring charges .................................... (270) (387) (158)

Pension curtailments and settlements, net ...................... — 517 —

Interest and other, net ................................... — 458 631

Total HP consolidated earnings before taxes .................... $ 10,473 $ 9,177 $ 7,191

HP allocates its assets to its business segments based on the primary segments benefiting from the

assets. Corporate and unallocated assets are composed primarily of cash and cash equivalents. As

described above, fiscal 2008 segment asset information is stated based on the fiscal 2008 organizational

155