HP 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

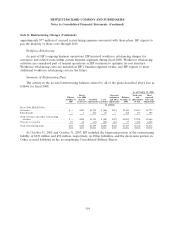

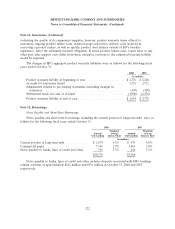

Note 12: Borrowings (Continued)

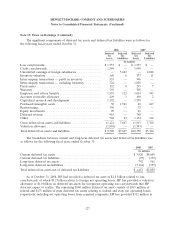

Long-Term Debt

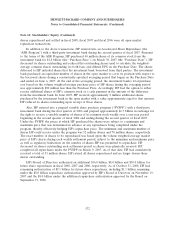

Long-term debt was as follows for the following fiscal years ended October 31:

2008 2007

In millions

U.S. Dollar Global Notes

2002 Shelf Registration Statement:

$500 issued at discount to par at 99.505% in June 2002 at 6.5%, due July 2012 . . . $ 499 $ 499

$500 issued at discount to par at 99.342% in March 2003 at 3.625%, matured and

paid March 2008 .............................................. — 500

2006 Shelf Registration Statement:

$600 issued at par in February 2007 at three-month USD LIBOR plus 0.11%, due

March 2012 .................................................. 600 600

$900 issued at discount to par of 99.938% in February 2007 at 5.25%, due March

2012 ....................................................... 900 900

$500 issued at discount to par of 99.694% in February 2007 at 5.4%, due March

2017 ....................................................... 499 499

$1,000 issued at par in June 2007 at three-month USD LIBOR plus 0.01%, due

June 2009 ................................................... 1,000 1,000

$1,000 issued at par in June 2007 at three-month USD LIBOR plus 0.06%, due

June 2010 ................................................... 1,000 1,000

$750 issued at par in March 2008 at three-month USD LIBOR plus 0.40%, due

September 2009 ............................................... 750 —

$1,500 issued at discount to par of 99.921% in March 2008 at 4.5%, due March

2013 ....................................................... 1,499 —

$750 issued at discount to par of 99.932% in March 2008 at 5.5%, due March

2018 ....................................................... 750 —

7,497 4,998

EDS Senior Notes

$700 issued October 1999 at 7.125%, due October 2009 .................... 712 —

$1,100 issued June 2003 at 6.0%, due August 2013 ........................ 1,150 —

$300 issued October 1999 at 7.45%, due October 2029 ..................... 316 —

2,178 —

Series A Medium-Term Notes

$50 issued December 2002 at 4.25%, matured and paid December 2007 ........ — 50

—50

Other

$505, U.S. dollar zero-coupon subordinated convertible notes, due 2017

(‘‘LYONs’’), issued in October and November 1997 at an imputed rate of

3.13%, and redeemed March 2008 .................................. — 371

Other, including capital lease obligations, at 3.75%-8.63%, due 2007-2029 ........ 597 263

597 634

Fair value adjustment related to SFAS No. 133 ............................ 78 (10)

Less current portion ............................................... (2,674) (675)

$ 7,676 $4,997

123