HP 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

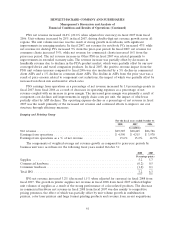

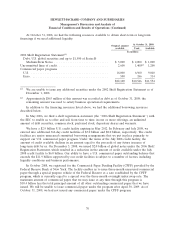

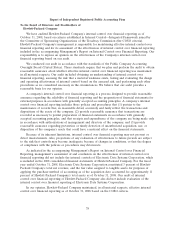

At October 31, 2008, we had the following resources available to obtain short-term or long-term

financings if we need additional liquidity:

At October 31, 2008

Original amount

available Used Available

In millions

2002 Shelf Registration Statement(1)

Debt, U.S. global securities and up to $1,500 of Series B

Medium-Term Notes ............................... $ 3,000 $ 2,000 $ 1,000

Uncommitted lines of credit ............................. 2,600 1,400(2) 1,200

Commercial paper programs

U.S. ............................................ 16,000 6,960 9,040

Euro. ........................................... 500 186 314

$22,100 $10,546 $11,554

(1) We are unable to issue any additional securities under the 2002 Shelf Registration Statement as of

December 1, 2008.

(2) Approximately $863 million of this amount was recorded as debt as of October 31, 2008; the

remaining amount was used to satisfy business operational requirements.

In addition to the financing resources listed above, we had the additional borrowing resources

described below.

In May 2006, we filed a shelf registration statement (the ‘‘2006 Shelf Registration Statement’’) with

the SEC to enable us to offer and sell, from time to time, in one or more offerings, an unlimited

amount of debt securities, common stock, preferred stock, depositary shares and warrants.

We have a $2.9 billion U.S. credit facility expiring in May 2012. In February and July 2008, we

entered into additional 364-day credit facilities of $3.0 billion and $8.0 billion, respectively. The credit

facilities are senior unsecured committed borrowing arrangements that we put in place primarily to

support our U.S. commercial paper program. Under the terms of the July 2008 credit facility, the

amount of credit available declines in an amount equal to the proceeds of any future issuance of

long-term debt by us. On December 5, 2008, we issued $2.0 billion of global notes under the 2006 Shelf

Registration Statement, which resulted in a reduction in the amount of credit available under the July

2008 credit facility to $6.0 billion. Our ability to have a U.S. commercial paper outstanding balance that

exceeds the $11.9 billion supported by our credit facilities is subject to a number of factors, including

liquidity conditions and business performance.

In October 2008, we registered for the Commercial Paper Funding Facility (CPFF) provided by the

Federal Reserve Bank of New York. The facility enables us to issue three-month unsecured commercial

paper through a special purpose vehicle of the Federal Reserve at a rate established by the CPFF

program, which is currently equal to a spread over the three-month overnight index swap rate. The

maximum amount of commercial paper that we may issue at any time through this program is

$10.4 billion less the total principal amount of all other outstanding commercial paper that we have

issued. We will be unable to issue commercial paper under the program after April 30, 2009. As of

October 31, 2008, we had not issued any commercial paper under the CPFF program.

70