HP 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

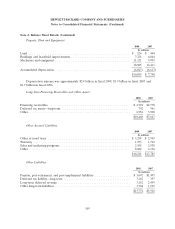

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

and participating security according to dividends declared (or accumulated) and participation rights in

undistributed earnings. FSP EITF 03-6-1 is effective for fiscal years beginning after December 15, 2008

on a retrospective basis and will be adopted by HP in the first quarter of fiscal 2010. HP is currently

evaluating the potential impact, if any, the adoption of FSP EITF 03-6-1 could have on its calculation

of EPS.

In November 2008, the FASB ratified EITF Issue No. 08-7, ‘‘Accounting for Defensive Intangible

Assets,’’ (‘‘EITF 08-7’’). EITF 08-7 applies to defensive intangible assets, which are acquired intangible

assets that the acquirer does not intend to actively use but intends to hold to prevent its competitors

from obtaining access to them. As these assets are separately identifiable, EITF 08-7 requires an

acquiring entity to account for defensive intangible assets as a separate unit of accounting. Defensive

intangible assets must be recognized at fair value in accordance with SFAS 141(R) and SFAS 157.

EITF 08-7 is effective for defensive intangible assets acquired in fiscal years beginning on or after

December 15, 2008 and will be adopted by HP in the first quarter of fiscal 2010. HP is currently

evaluating the potential impact, if any, of the adoption of EITF 08-7 on its consolidated results of

operations and financial condition.

During fiscal 2008, HP adopted the following accounting standard:

FASB Interpretation No. 48, ‘‘Accounting for Uncertainty in Income Taxes, an interpretation of

FASB Statement No. 109’’ (‘‘FIN 48’’). See Note 13 for the effect of applying FIN 48 on the

Consolidated Balance Sheets.

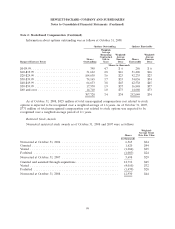

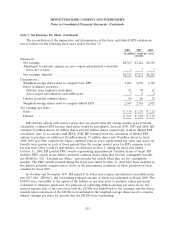

Note 2: Stock-Based Compensation

At October 31, 2008, HP has the stock-based employee compensation plans described below. The

total compensation expense before taxes related to these plans was $606 million, $629 million and

$536 million for fiscal 2008, 2007 and 2006, respectively.

Employee Stock Purchase Plan

HP sponsors the Hewlett-Packard Company 2000 Employee Stock Purchase Plan, also known as

the Share Ownership Plan (the ‘‘ESPP’’), pursuant to which eligible employees may contribute up to

10% of base compensation, subject to certain income limits, to purchase shares of HP’s common stock.

Employees purchase stock pursuant to the ESPP semi-annually at a price equal to 85% of the fair

market value on the purchase date. HP recognizes expense based on a 15% discount on a fair market

value.

95