HP 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

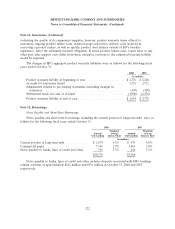

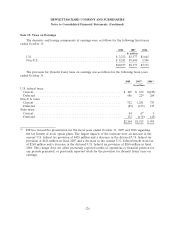

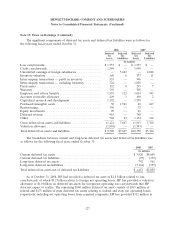

Note 10: Financing Receivables and Operating Leases (Continued)

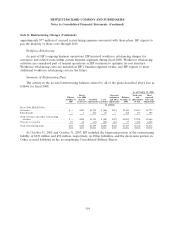

As of October 31, 2008, scheduled maturities of HP’s minimum lease payments receivable were as

follows for the following fiscal years ended October 31:

2009 2010 2011 2012 2013 Thereafter Total

In millions

Scheduled maturities of minimum lease payments

receivable .............................. $2,535 $1,450 $788 $340 $159 $66 $5,338

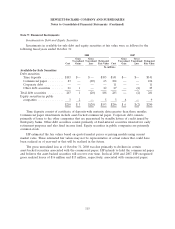

Equipment leased to customers under operating leases was $2.3 billion at October 31, 2008 and

$2.4 billion at October 31, 2007 and is included in machinery and equipment. Accumulated

depreciation on equipment under lease was $0.5 billion at October 31, 2008 and $0.6 billion at

October 31, 2007. As of October 31, 2008, minimum future rentals on non-cancelable operating leases

related to leased equipment were as follows for the following fiscal years ended October 31:

2009 2010 2011 2012 2013 Thereafter Total

In millions

Minimum future rentals on non-cancelable operating

leases ..................................... $887 $564 $250 $57 $22 $12 $1,792

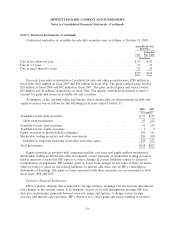

Note 11: Guarantees

Guarantees and Indemnifications

In the ordinary course of business, HP may provide certain clients, principally governmental

entities, with subsidiary performance guarantees and/or financial performance guarantees, which may be

backed by standby letters of credit or surety bonds. In general, HP would be liable for the amounts of

these guarantees in the event HP or HP’s subsidiaries’ nonperformance permits termination of the

related contract by the client, the likelihood of which HP believes is remote. HP believes that the

company is in compliance with the performance obligations under all material service contracts for

which there is a performance guarantee.

As a result of the acquisition of EDS, HP acquired certain service contracts supported by client

financing or securitization arrangements. Under specific circumstances involving non performance

resulting in service contract termination or failure to comply with terms under the financing

arrangement, HP would be required to acquire certain assets. HP considers the possibility of its failure

to comply to be remote and the asset amounts involved to be immaterial.

In the ordinary course of business, HP enters into contractual arrangements under which HP may

agree to indemnify the third party to such arrangement from any losses incurred relating to the services

they perform on behalf of HP or for losses arising from certain events as defined within the particular

contract, which may include, for example, litigation or claims relating to past performance. Such

indemnification obligations may not be subject to maximum loss clauses. Historically, payments made

related to these indemnifications have been immaterial.

Warranty

HP provides for the estimated cost of product warranties at the time it recognizes revenue. HP

engages in extensive product quality programs and processes, including actively monitoring and

121