HP 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

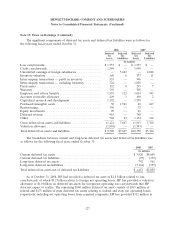

Note 13: Taxes on Earnings (Continued)

valuation allowance for deferred tax assets related to such net operating losses, which begin to expire in

fiscal 2010.

As of October 31, 2008, HP had recorded deferred tax assets for various tax credit carryforwards

of $1.5 billion including $958 million of foreign tax credit carryforwards subject to a $47 million

valuation allowance, which will begin to expire in fiscal 2015. HP had alternative minimum tax credit

carryforwards of $81 million, which do not expire, and research and development credit carryforwards

of $136 million, which will begin to expire in fiscal 2019. HP also had tax credit carryforwards of

$374 million in various states and foreign countries, for which HP has provided a valuation allowance

of $233 million to reduce the related deferred tax asset. These credits begin to expire in fiscal 2009.

Gross deferred tax assets at October 31, 2008 and 2007 were reduced by valuation allowances of

$1.8 billion and $1.5 billion, respectively. The valuation allowance increased by $258 million in 2008.

The valuation allowance increases consisted of $449 million recorded for deferred tax assets acquired in

current year acquisitions, $126 million recorded for deferred tax assets related to certain federal and

state net operating loss carryovers and tax credits, and $47 million related to deferred tax assets for

foreign tax credit carryovers. These increases were partially offset by a $203 million net reduction in the

valuation allowances due to FIN48 adoption adjustments to deferred tax assets related to foreign net

operating loss carryovers, and $161 million in the valuation allowances for deferred tax assets related to

foreign tax credits and net operating losses carryovers. Of the $1.8 billion in valuation allowances at

October 31, 2008, $565 million was related to deferred tax assets for acquired companies that existed at

the time of acquisition. Prior to the effective date of SFAS 141(R), to the extent that HP determines

that the realization of these deferred tax assets is more likely than not, the reversal of the valuation

allowance would be recorded as a reduction of goodwill instead of the provision for income taxes.

Excess tax benefits resulting from the exercise of employee stock options and other employee stock

programs, are recorded as an increase in stockholders’ equity and were approximately $316 million in

fiscal 2008, $530 million in fiscal 2007 and $356 million in fiscal 2006.

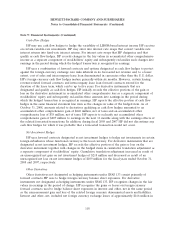

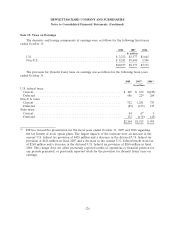

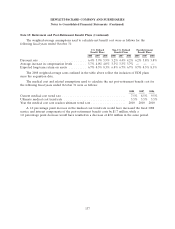

The differences between the U.S. federal statutory income tax rate and HP’s effective tax rate

were as follows for the following fiscal years ended October 31:

2008 2007 2006

U.S. federal statutory income tax rate ......................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit .................... 1.3 0.5 (0.1)

Lower rates in other jurisdictions, net ......................... (16.9) (13.2) (11.9)

Research and development credit ............................ (0.4) (0.6) (0.2)

Valuation allowance ...................................... — (1.7) (1.0)

U.S. federal tax audit settlement ............................. — — (7.9)

Accrued taxes due to post-acquisition integration ................. 2.0 — —

Other, net ............................................. (0.5) 0.8 (0.1)

20.5% 20.8% 13.8%

In fiscal 2008, HP recorded $251 million of net income tax expense related to items unique to the

year. The recorded amounts consisted of a tax charge of $205 million associated with post-acquisition

EDS integration, $44 million for the adjustment to estimated fiscal 2007 tax accruals upon filing the

2007 U.S. federal income tax return, and net tax charges of $2 million attributable to other items.

128