HP 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

liability (debt) and equity (conversion option) components of the instrument in a manner that reflects

the issuer’s non-convertible debt borrowing rate. FSP APB 14-1 is effective for fiscal years beginning

after December 15, 2008 on a retroactive basis and will be adopted by us in the first quarter of fiscal

2010. We are currently evaluating the potential impact of the adoption of FSP APB 14-1 on our

consolidated results of operations and financial condition.

In June 2008, the FASB issued FSP Emerging Issues Task Force (‘‘EITF’’) 03-6-1, ‘‘Determining

Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities.’’ FSP

EITF 03-6-1 clarifies that share-based payment awards that entitle their holders to receive

nonforfeitable dividends or dividend equivalents before vesting should be considered participating

securities. We have some grants of restricted stock that contain non-forfeitable rights to dividends and

will be considered participating securities upon adoption of FSP EITF 03-6-1. As participating

securities, we will be required to include these instruments in the calculation of earnings per share

(‘‘EPS’’), and we will need to calculate EPS using the ‘‘two-class method.’’ The two-class method of

computing EPS is an earnings allocation formula that determines EPS for each class of common stock

and participating security according to dividends declared (or accumulated) and participation rights in

undistributed earnings. FSP EITF 03-6-1 is effective for fiscal years beginning after December 15, 2008

on a retrospective basis and will be adopted by us in the first quarter of fiscal 2010. We are currently

evaluating the potential impact, if any, the adoption of FSP EITF 03-6-1 could have on our calculation

of EPS.

In November 2008, the FASB ratified EITF Issue No. 08-7, ‘‘Accounting for Defensive Intangible

Assets,’’ (‘‘EITF 08-7’’). EITF 08-7 applies to defensive intangible assets, which are acquired intangible

assets that the acquirer does not intend to actively use but intends to hold to prevent its competitors

from obtaining access to them. As these assets are separately identifiable, EITF 08-7 requires an

acquiring entity to account for defensive intangible assets as a separate unit of accounting. Defensive

intangible assets must be recognized at fair value in accordance with SFAS 141(R) and SFAS 157.

EITF 08-7 is effective for defensive intangible assets acquired in fiscal years beginning on or after

December 15, 2008 and will be adopted by us in the first quarter of fiscal 2010. We are currently

evaluating the potential impact, if any, of the adoption of EITF 08-7 on our consolidated results of

operations and financial condition.

During fiscal 2008, we adopted FIN 48. See Note 13 to the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference, for the effect of applying FIN 48.

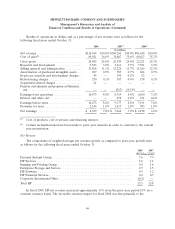

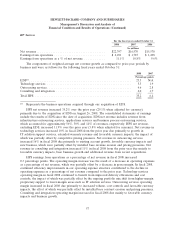

RESULTS OF OPERATIONS

The following discussion compares the historical results of operations on a GAAP basis for the

fiscal years ended October 31, 2008, 2007, and 2006. As discussed above, we have included the results

of the business operations acquired from EDS in our consolidated results of operations beginning on

August 26, 2008, the closing date of the EDS acquisition, and we have included those business

operations as a separate business unit within HPS for financial reporting purposes.

48