GameStop 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

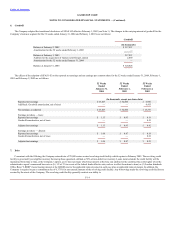

during the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, were $849, $715 and $660, respectively.

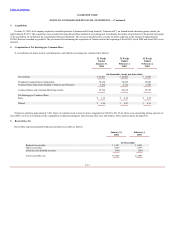

15. Certain Relationships and Related Transactions

The Company operates departments within ten bookstores operated by Barnes & Noble. The Company pays a license fee to Barnes & Noble in amounts equal to

7.0% of the gross sales of such departments. Management deems the license fee to be reasonable and based upon terms equivalent to those that would prevail in an

arm’s length transaction. During the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, these charges amounted to $974, $1,103 and $1,098,

respectively.

The Company participates in Barnes & Noble’s worker’s compensation, property and general liability insurance programs. The costs incurred by Barnes & Noble

under these programs are allocated to the Company based upon the Company’s total payroll expense, property and equipment, and insurance claim history.

Management deems the allocation methodology to be reasonable. During the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, these allocated

charges amounted to $2,363, $1,726 and $1,291, respectively.

Prior to the completion of the Offering, the Company utilized the management and strategic advisory services of Leonard Riggio, the Chairman of Barnes & Noble,

during the normal course of its operations. The annual compensation paid by Barnes & Noble to Leonard Riggio was allocated to the Company based upon the amount

of time Mr. Riggio devoted to the Company as well as his duties and responsibilities. Management deemed the allocation methodology to be reasonable. During the

52 weeks ended February 2, 2002, this allocated compensation amounted to $325.

In July 2003, the Company purchased an airplane from a company controlled by a member of the Board of Directors. The purchase price was $9,500 and was

negotiated through an independent third party following an independent appraisal.

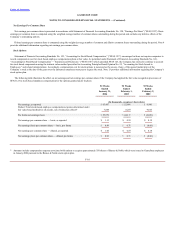

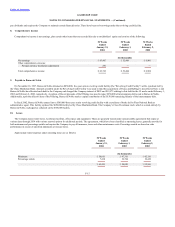

16. Supplemental Cash Flow Information

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands)

Cash paid during the period for:

Interest $ 308 $ 47,236 $

—

Income taxes 56,555 14,641

—

Subsidiaries acquired:

Goodwill 2,869 — $9,665

Accrual of additional acquisition payments due to former owners

—

— (9,665)

Cash received in acquisition 252 —

—

Net assets acquired (or liabilities assumed) 158 —

—

Cash paid $3,279 $ — $

—

Non-cash financing activity:

Barnes & Noble capital contribution $

—

$150,000 $

—

F-20