GameStop 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

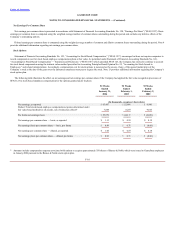

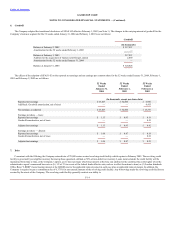

The weighted-average fair value of the options granted during the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002 were estimated at

$5.30, $8.08 and $2.75, respectively, using the Black-Scholes option pricing model with the following assumptions:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

Volatility 61.6% 61.9% 61.1%

Risk-free interest rate 3.19% 4.60% 4.97%

Expected life (years) 6.0 6.0 6.0

Expected dividend yield 0% 0% 0%

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. In preparing these financial statements, management has made its best estimates and judgments of certain amounts

included in the financial statements, giving due consideration to materiality. Changes in the estimates and assumptions used by management could have significant

impact on the Company’s financial results. Actual results could differ from those estimates.

Fair Values of Financial Instruments

The carrying values of cash and cash equivalents reported in the accompanying consolidated balance sheets approximate fair value due to the short-term maturities

of these assets.

Recently Issued Accounting Pronouncements

There were no recent accounting pronouncements that had an effect on the Company.

Reclassifications

Certain reclassifications have been made to conform the prior period data to the current year presentation.

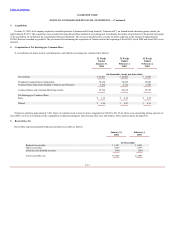

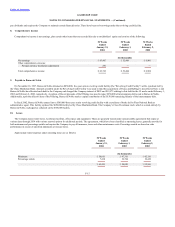

2. Effect of Accounting Change (Unaudited)

In November 2002, the FASB Emerging Issues Task Force (“Task Force”) issued EITF Issue 02-16, “Accounting by a Customer (including a Reseller) for Cash

Consideration Received from a Vendor,” (“EITF 02-16”). EITF 02-16 addresses the following two issues: (i) the classification in a reseller’s financial statements of

cash consideration received from a vendor (“Issue 1”); and (ii) the timing of recognition by a reseller of a rebate or refund from a vendor that is contingent upon

achieving a specific cumulative level of purchases or remaining a customer for a specified time period (“Issue 2”). Issue 1 stipulates that cash consideration received

from a vendor is presumed to be a reduction of the prices of the vendor’s products and should, therefore, be recognized as a reduction of cost of merchandise sold when

recognized in the reseller’s financial statements. However, that presumption is overcome when the consideration is either (a) a payment for assets or services delivered

to the vendor, in which case the cash consideration should be recognized as revenue (or other income, as appropriate) when recognized in the reseller’s income

statement, or (b) a reimbursement of a specific, incremental, identifiable cost incurred by the reseller in selling the vendor’s

F-11