GameStop 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Dividends

The Company has never declared or paid any dividends on its common stock. We may consider in the future the advisability of paying dividends. However, our

payment of dividends is and will continue to be restricted by or subject to, among other limitations, the terms of the revolving credit facility we entered into in February

2002, applicable provisions of federal and state laws, our earnings and various business considerations, including our financial condition, results of operations, cash

flow, the level of our capital expenditures, our future business prospects, our status as a holding company and such other matters that our board of directors deems

relevant. See “Liquidity and Capital Resources” included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In March 2003, the Board of Directors authorized a common stock repurchase program for the purchase of up to $50.0 million of the Company’s Class A common

shares. The Company may repurchase shares from time to time in the open market or through privately negotiated transactions, depending on prevailing market

conditions and other factors. The repurchased shares will be held in treasury. During the 39 weeks ended November 1, 2003, the Company repurchased 2,304,100

shares at an average share price of $15.19. No shares were repurchased during the 13 weeks ended January 31, 2004. The Company has $14,994,000 available for

purchases under this repurchase program.

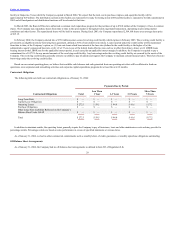

Securities Authorized for Issuance under Equity Compensation Plans

Information for our equity compensation plans in effect as of January 31, 2004, is as follows:

Number of securities

remaining available for

Number of securities to be Weighted-average future issuance under

issued upon exercise of exercise price of equity compensation plans

outstanding options, outstanding options, (excluding securities

warrants and rights warrants and rights reflected in column (a))

Plan category (a) (b) (c)

Equity compensation plans approved

by security holders 11,307,000 $9.63 6,464,000

Equity compensation plans not

approved by security holders 0 not applicable 0

Total 11,307,000 $9.63 6,464,000

On March 2, 2004, an additional 1,591,650 options to purchase our Class A common stock were granted under the 2001 Incentive Plan at an exercise price of

$18.57 per share. These options vest in equal increments over three years and expire on March 1, 2014.

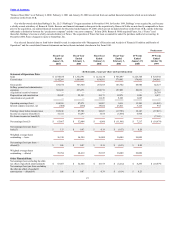

Item 6. Selected Consolidated Financial Data

We completed our initial public offering on February 12, 2002. Before that date, we were a wholly-owned subsidiary of Barnes & Noble.

The following table sets forth our selected consolidated financial and operating data for the periods and at the dates indicated. Our fiscal year is composed of 52 or

53 weeks ending on the Saturday closest to January 31. The fiscal years ended January 31, 2004, February 1, 2003, February 2, 2002 and January 29, 2000 consisted of

52 weeks and the fiscal year ended February 3, 2001 consisted of 53 weeks. The “Statement of Operations Data” for the fiscal years 2003, 2002 and 2001 and the

“Balance Sheet Data” as of January 31, 2004 and February 1, 2003 are derived from, and are qualified by reference to, our audited financial statements which are

included elsewhere in this Form 10-K. The “Statement of Operations Data” for the 39 weeks ended October 30, 1999, the 13 weeks ended January 29, 2000 and for the

fiscal year ended February 3, 2001 and the

20