GameStop 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

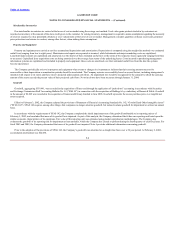

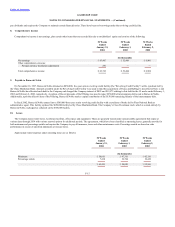

differences, to the extent they are temporary, are recorded as deferred tax assets and liabilities under SFAS 109 and consisted of the following components:

January 31, February 1,

2004 2003

(In thousands)

Deferred tax asset:

Allowance for doubtful accounts $ 62 $ 102

Inventory capitalization costs 1,694 1,064

Inventory obsolescence reserve 4,200 3,251

Accrued liabilities 273 878

Gift certificate liability 1,912 536

Deferred rents 1,353 1,209

Accrued state taxes (480) 404

Total deferred tax benefits 9,014 7,444

Deferred tax liabilities:

Goodwill (15,814) (10,521)

Translation adjustment (200)

—

Fixed assets (4,170) (1,614)

Accrued state taxes 1,100 334

Total deferred tax liabilities (19,084) (11,801)

Net $ (10,070) $ (4,357)

Financial statements:

Current deferred tax assets $ 7,661 $ 6,034

Non-current deferred tax liabilities $(17,731) $(10,391)

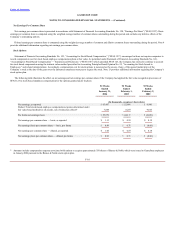

13. Stock Option Plan

Effective August 2001, Barnes & Noble approved the 2001 Incentive Plan of GameStop Corp. The 2001 Incentive Plan assumed (by the issuance of replacement

options) all stock options outstanding as of the effective date under the 2000 Incentive Plan of GameStop, Inc. under the same terms.

Effective September 13, 2000, Barnes & Noble approved the 2000 Incentive Plan of GameStop, Inc. (together with the 2001 Incentive Plan of Gamestop Corp, the

“Option Plans”). The Option Plans, as amended, provide a maximum aggregate amount of 20,000 shares of common stock with respect to which options may be

granted and provide for the granting of incentive stock options, non-qualified stock options, and restricted stock, which may include, without limitation, restrictions on

the right to vote such shares and restrictions on the right to receive dividends on such shares. The options to purchase common shares generally are issued at fair market

value on the date of grant. Generally, the options vest and become exercisable ratably over a three-year period, commencing one year after the grant date, and expire ten

years from issuance.

Option Plan Grants

On December 5, 2000, the Company granted 4,488 options to its employees based upon the fair value of the shares at the date of grant ($3.53 per share) as

determined by an independent appraisal. On June 13, 2001, options to acquire 4,500 shares were granted with immediate vesting at an exercise price of $4.51 per share

to Leonard Riggio based on the fair value at the date of grant as determined by an independent appraisal. On

F-18