GameStop 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

facility in Grapevine, Texas which the Company acquired in March 2004. We expect that the total cost to purchase, improve and equip this facility will be

approximately $29 million. The distribution systems in this facility are expected to be ready for testing in late 2004 and the facility is expected to be fully-operational in

2005 and all headquarters and distribution functions will be relocated at that time.

In March 2003, the Board of Directors authorized a common stock repurchase program for the purchase of up to $50.0 million of the Company’s Class A common

shares. The Company may repurchase shares from time to time in the open market or through privately negotiated transactions, depending on prevailing market

conditions and other factors. The repurchased shares will be held in treasury. During fiscal 2003, the Company repurchased 2,304,100 shares at an average share price

of $15.19.

In February 2002, the Company entered into a $75.0 million senior secured revolving credit facility which expires in February 2005. The revolving credit facility is

governed by an eligible inventory borrowing base agreement, defined as 50% of non-defective inventory. Loans incurred under the credit facility will be maintained

from time to time, at the Company’s option, as: (1) base rate loans which bear interest at the base rate (defined in the credit facility as the higher of (a) the

administrative agent’s announced base rate, or (b) 1/2 of 1% in excess of the federal funds effective rate, each as in effect from time to time); or (2) LIBOR loans

bearing interest at the LIBOR rate for the applicable interest period, in each case plus an applicable interest margin. In addition, the Company is required to pay a

commitment fee of 0.375% for any unused amounts of the revolving credit facility. Any borrowings under the revolving credit facility are secured by the assets of the

Company. The revolving credit facility generally restricts our ability to pay dividends and requires the Company to maintain certain financial ratios. There have been no

borrowings under the revolving credit facility.

Based on our current operating plans, we believe that available cash balances and cash generated from our operating activities will be sufficient to fund our

operations, store expansion and remodeling activities and corporate capital expenditure programs for at least the next 12 months.

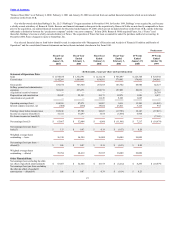

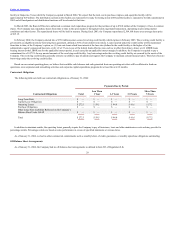

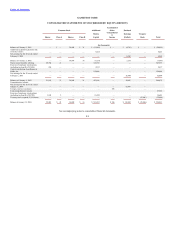

Contractual Obligations

The following table sets forth our contractual obligations as of January 31, 2004:

Payments Due by Period

Less Than More Than

Contractual Obligations Total 1 Year 1-3 Years 3-5 Years 5 Years

Long-Term Debt $

—

$

—

$

—

$

—

$

—

Capital Lease Obligations $

—

$

—

$

—

$

—

$

—

Operating Leases $272.3 $59.5 $94.0 $ 61.6 $57.2

Purchase Obligations $

—

$

—

$

—

$

—

$

—

Other Long-Term Liabilities Reflected on the Company’s

Balance Sheet Under GAAP $

—

$

—

$

—

$

—

$

—

Total $ 272.3 $ 59.5 $ 94.0 $ 61.6 $ 57.2

In addition to minimum rentals, the operating leases generally require the Company to pay all insurance, taxes and other maintenance costs and may provide for

percentage rentals. Percentage rentals are based on sales performance in excess of specified minimums at various stores.

As of January 31, 2004, we had no other commercial commitments such as standby letters of credit, guarantees, or standby repurchase obligations outstanding.

Off-Balance Sheet Arrangements

As of January 31, 2004, the Company had no off-balance sheet arrangements as defined in Item 303 of Regulation S-K.

28