GameStop 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

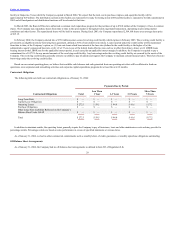

Table of Contents

Impact of Inflation

We do not believe that inflation has had a material effect on our net sales or results of operations.

Certain Relationships and Related Transactions

The Company operates departments within ten bookstores operated by Barnes & Noble. The Company pays a license fee to Barnes & Noble in amounts equal to

7.0% of the gross sales of such departments. Management deems the license fee to be reasonable and based upon terms equivalent to those that would prevail in an

arm’s length transaction. During the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, these charges amounted to $1.0 million, $1.1 million

and $1.1 million, respectively.

The Company participates in Barnes & Noble’s worker’s compensation, property and general liability insurance programs. The costs incurred by Barnes & Noble

under these programs are allocated to the Company based upon the Company’s total payroll expense, property and equipment, and insurance claim history.

Management deems the allocation methodology to be reasonable. During the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, these allocated

charges amounted to $2.4 million, $1.7 million and $1.3 million, respectively.

Prior to the completion of the Company’s initial public offering, the Company utilized the management and strategic advisory services of Leonard Riggio, the

Chairman of Barnes & Noble, during the normal course of its operations. The annual compensation paid by Barnes & Noble to Leonard Riggio was allocated to the

Company based upon the amount of time Mr. Riggio devoted to the Company as well as his duties and responsibilities. Management deemed the allocation

methodology to be reasonable. During the 52 weeks ended February 2, 2002, this allocated compensation amounted to $0.3 million.

In July 2003, the Company purchased an airplane from a company controlled by a member of the Board of Directors. The purchase price was $9.5 million and was

negotiated through an independent third party following an independent appraisal.

Recent Accounting Pronouncements

There were no recent accounting pronouncements that had an effect on the Company.

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit realized during the fourth quarter which includes the

holiday selling season. Results for any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year. Quarterly results may fluctuate

materially depending upon, among other factors, the timing of new product introductions and new store openings, sales contributed by new stores, increases or

decreases in comparable store sales, adverse weather conditions, shifts in the timing of certain holidays or promotions and changes in our merchandise mix.

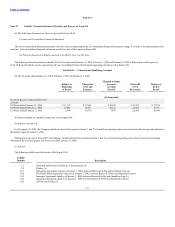

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Exposure

We do not use derivative financial instruments to hedge interest rate exposure. We limit our interest rate risks by investing our excess cash balances in short-term,

highly-liquid instruments with an original maturity of three months or less. We do not expect any material losses from our invested cash balances, and we believe that

our interest rate exposure is modest.

Foreign Exchange Exposure

We do not believe we have material foreign currency exposure, because only a very immaterial portion of our business is transacted in other than United States

currency. The Company historically has not entered into hedging transactions with respect to its foreign currency, but may do so in the future.

29