GameStop 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

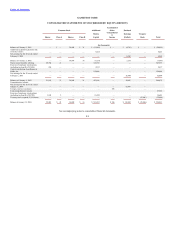

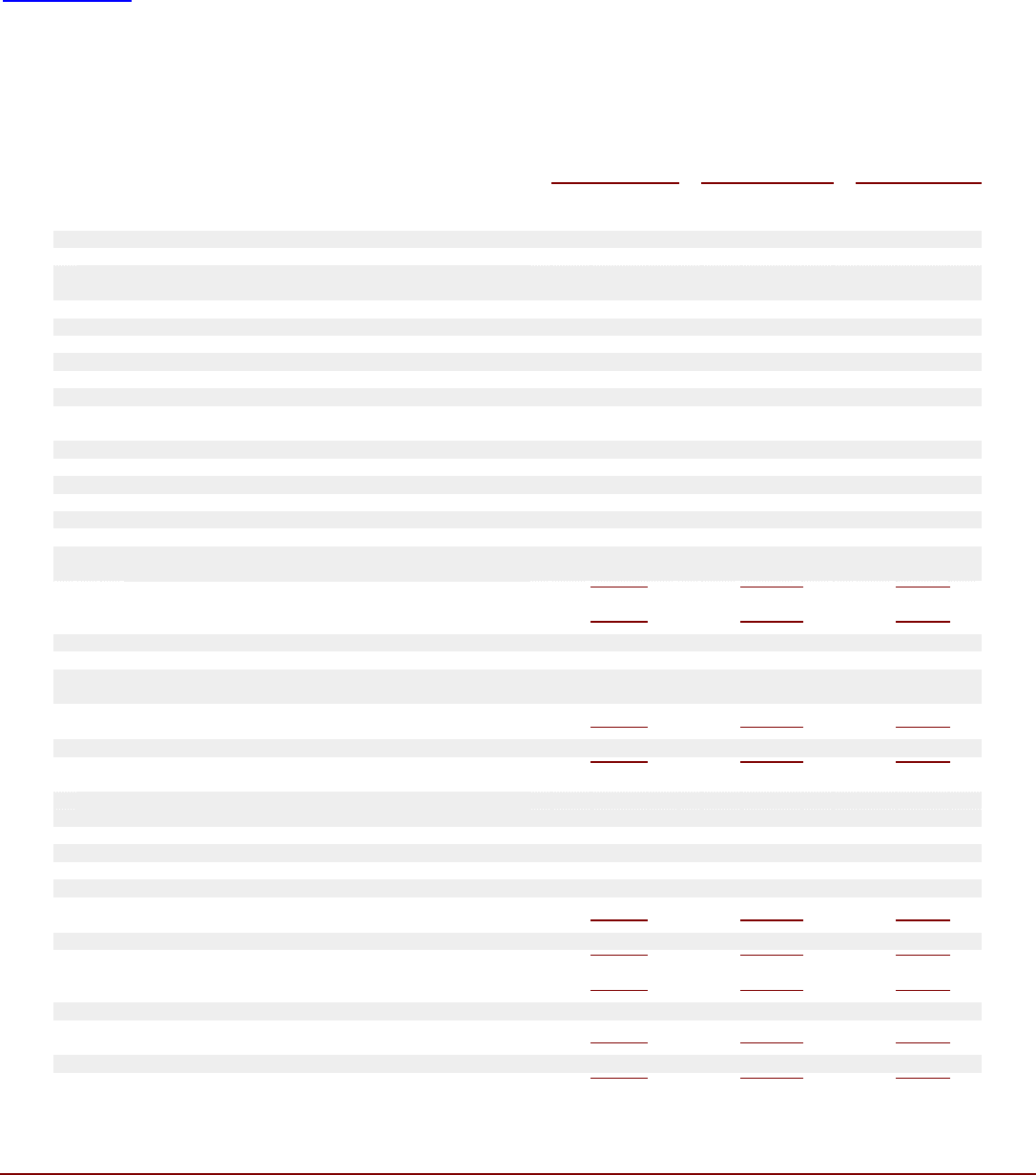

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

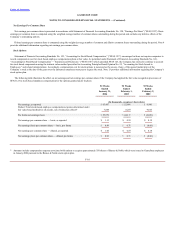

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands)

Cash flows from operating activities:

Net earnings $ 63,467 $ 52,404 $ 6,960

Adjustments to reconcile net earnings to net cash flows provided by

operating activities:

Depreciation and amortization 28,947 22,553 19,172

Amortization of goodwill —

—

11,125

Amortization of loan cost 313 242

—

Deferred taxes 5,713 4,710 319

Tax benefit realized from exercise of stock options by employees 9,702 1,906

—

Loss on disposal of property and equipment 213 205 1,035

Increase in other long-term liabilities for scheduled rent increases in

long-term leases 338 329 347

Minority interest (298)

—

—

Changes in operating assets and liabilities, net

Receivables, net (1,954) (963) (2,204)

Merchandise inventories (59,811) (23,018) (29,498)

Prepaid expenses and other current assets (4,111) (1,872) 5,427

Prepaid taxes (12,775)

—

—

Accounts payable, accrued liabilities and accrued income taxes

payable 40,056 36,374 65,436

Net cash flows provided by operating activities 69,800 92,870 78,119

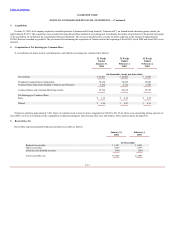

Cash flows from investing activities:

Purchase of property and equipment (63,007) (39,529) (20,462)

Acquisition of controlling interest in Gamesworld Group Limited, net of

cash received (3,027)

—

—

Net increase in other noncurrent assets (522) (788) (23)

Net cash flows used in investing activities (66,556) (40,317) (20,485)

Cash flows from financing activities:

Issuance of 20,764 shares relating to the public offering, net of the related

expenses — 347,339

—

Issuance of shares relating to employee stock options 6,899 1,011

—

Repayment of debt due to Barnes & Noble, Inc. — (250,000)

—

Repayment of debt of Gamesworld Group Limited (2,296)

—

—

Purchase of treasury shares through repurchase program (35,006)

—

—

Net increase in other payable to Barnes & Noble, Inc. — 377 14,475

Net cash flows (used in) provided by financing activities (30,403) 98,727 14,475

Exchange rate effect on cash and cash equivalents 34

—

—

Net increase (decrease) in cash and cash equivalents (27,125) 151,280 72,109

Cash and cash equivalents at beginning of period 232,030 80,750 8,641

Cash and cash equivalents at end of period $204,905 $232,030 $80,750

See accompanying notes to consolidated financial statements.

F-6