GameStop 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

pay dividends and requires the Company to maintain certain financial ratios. There have been no borrowings under the revolving credit facility.

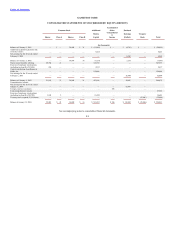

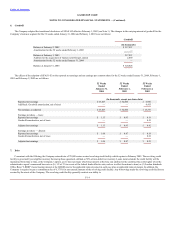

8. Comprehensive Income

Comprehensive income is net earnings, plus certain other items that are recorded directly to stockholders’ equity and consists of the following:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands)

Net earnings $63,467 $52,404 $6,960

Other comprehensive income:

Foreign currency translation adjustments 296

—

—

Total comprehensive income $ 63,763 $ 52,404 $ 6,960

9. Payable to Barnes & Noble

On November 18, 1997, Barnes & Noble obtained an $850,000, five-year senior revolving credit facility (the “Revolving Credit Facility”) with a syndicate led by

the Chase Manhattan Bank. Amounts available under the Revolving Credit Facility were used to fund the acquisitions of Funco and Babbage’s described in Note 1, and

Barnes & Noble has allocated such debt to the Company and charged the Company interest of $825 and $19,575 relating to this debt for the 52 weeks ended February 1,

2003 and February 2, 2002, respectively. A portion of the net proceeds of the Offering was used to repay $250,000 of intercompany debt owed to Barnes & Noble.

Additionally, upon the effective date of the Offering, Barnes & Noble made a capital contribution of the $150,000 remaining balance of the intercompany debt.

In fiscal 2002, Barnes & Noble entered into a $500,000 three-year senior revolving credit facility with a syndicate of banks led by Fleet National Bank as

administrative agent. This facility replaced the $850,000 facility led by Chase Manhattan Bank. The Company’s Class B common stock, which is owned entirely by

Barnes & Noble, is pledged as collateral on the $500,000 facility.

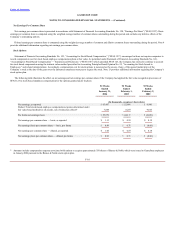

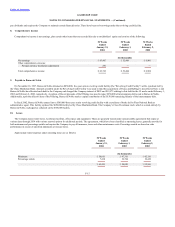

10. Leases

The Company leases retail stores, warehouse facilities, office space and equipment. These are generally leased under noncancelable agreements that expire at

various dates through 2034 with various renewal options for additional periods. The agreements, which have been classified as operating leases, generally provide for

both minimum and percentage rentals and require the Company to pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales

performance in excess of specified minimums at various stores.

Approximate rental expenses under operating leases are as follows:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands)

Minimum $58,016 $47,316 $42,110

Percentage rentals 7,418 10,704 10,436

$65,434 $58,020 $52,546

F-15