GameStop 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

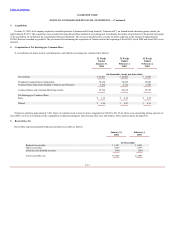

Revenue Recognition

Revenue from the sales of the Company’s products is recognized at the time of sale. The sales of used video game products are recorded at the retail price charged

to the customer. Sales returns (which are not significant) are recognized at the time returns are made.

Subscription and advertising revenues are recorded upon release of magazines for sale to consumers and are stated net of sales discounts. Magazine subscription

revenue is recognized on a straight-line basis over the subscription period.

Pre-Opening Expenses

All costs associated with the opening of new stores are expensed as incurred. Pre-opening expenses are included in selling, general and administrative expenses in

the accompanying consolidated statements of operations.

Closed Store Expenses

Upon a formal decision to close or relocate a store, the Company charges unrecoverable costs to expense. Such costs include the net book value of abandoned

fixtures and leasehold improvements and a provision for future lease obligations, net of expected sublease recoveries. Costs associated with store closings are included

in selling, general and administrative expenses in the accompanying consolidated statements of operations.

Advertising Expenses

The Company expenses advertising costs for newspapers and other media when the advertising takes place. Advertising expenses for newspapers and other media

during the 52 weeks ended January 31, 2004, February 1, 2003 and February 2, 2002, were $7,044, $4,258 and $838, respectively.

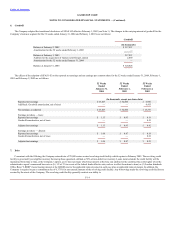

Income Taxes

Following the closing of the Offering, Barnes & Noble owned less than 80% of GameStop and, accordingly, is no longer permitted to consolidate GameStop’s

operations for income tax purposes. Accordingly, the financial statements reflect income tax expense as if GameStop had filed separate income tax returns as a

“C” corporation on a stand-alone basis. As a result, the Company accounts for income taxes in accordance with the provisions of Statement of Financial Accounting

Standards No. 109 “Accounting for Income Taxes” (“SFAS 109”). SFAS 109 utilizes an asset and liability approach, and deferred taxes are determined based on the

estimated future tax effect of differences between the financial reporting and tax bases of assets and liabilities using enacted tax rates.

For the periods prior to the Offering, GameStop was included in the consolidated federal tax return of Barnes & Noble. The income tax provisions recorded in the

financial statements for these periods flowed through the payable to Barnes & Noble.

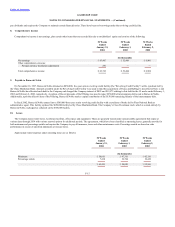

Foreign Currency Translation

Gamestop has determined that the functional currency of its foreign subsidiary is the subsidiary’s local currency (the EURO). The assets and liabilities of the

subsidiary are translated at the applicable exchange rate as of the end of the balance sheet date and revenue and expenses are translated at an average rate over the

period. Currency translation adjustments are recorded as a component of other comprehensive income.

F-9