GameStop 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

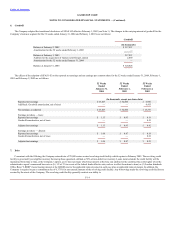

6. Goodwill

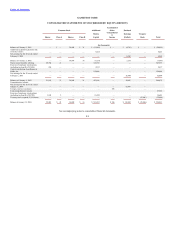

The Company adopted the transitional disclosures of SFAS 142 effective February 3, 2002 (see Note 1). The changes in the carrying amount of goodwill for the

Company’s business segment for the 52 weeks ended January 31, 2004 and February 1, 2003 were as follows:

Goodwill

(In thousands)

Balance at February 2, 2002 $317,957

Amortization for the 52 weeks ended February 1, 2003

—

Balance at February 1, 2003 317,957

Addition for the acquisition of Gamesworld Group Limited 2,869

Amortization for the 52 weeks ended January 31, 2004

—

Balance at January 31, 2004 $ 320,826

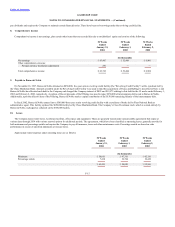

The effects of the adoption of SFAS 142 on the reported net earnings and net earnings per common share for the 52 weeks ended January 31, 2004, February 1,

2003 and February 2, 2002 are as follows:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands, except per share data)

Reported net earnings $63,467 $52,404 $6,960

Add Back: Goodwill amortization, net of taxes

—

—

8,413

Net earnings, as adjusted $63,467 $52,404 $15,373

Earnings per share — basic:

Reported net earnings $1.13 $0.93 $0.19

Goodwill amortization, net of taxes

—

—

0.23

Adjusted net earnings $1.13 $0.93 $0.42

Earnings per share — diluted:

Reported net earnings $1.06 $0.87 $0.18

Goodwill amortization, net of taxes

—

—

0.21

Adjusted net earnings $1.06 $0.87 $0.39

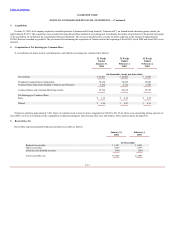

7. Debt

Concurrent with the Offering, the Company entered into a $75,000 senior secured revolving credit facility which expires in February 2005. The revolving credit

facility is governed by an eligible inventory borrowing base agreement, defined as 50% of non-defective inventory. Loans incurred under the credit facility will be

maintained from time to time, at the Company’s option, as (1) base rate loans which bear interest at the base rate (defined in the credit facility as the higher of (a) the

administrative agent’s announced base rate or (b) 1/2 of 1% in excess of the federal funds effective rate, each as in effect from time to time) or (2) London Interbank

Office Rate (“LIBOR”) loans bearing interest at the LIBOR rate for the applicable interest period, in each case plus an applicable interest margin. In addition, the

Company is required to pay a commitment fee of 0.375% for any unused amounts of the revolving credit facility. Any borrowings under the revolving credit facility are

secured by the assets of the Company. The revolving credit facility generally restricts our ability to

F-14