GameStop 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

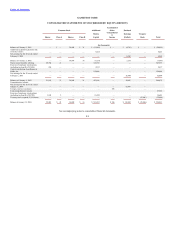

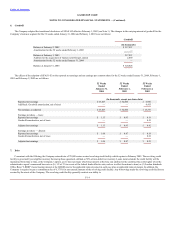

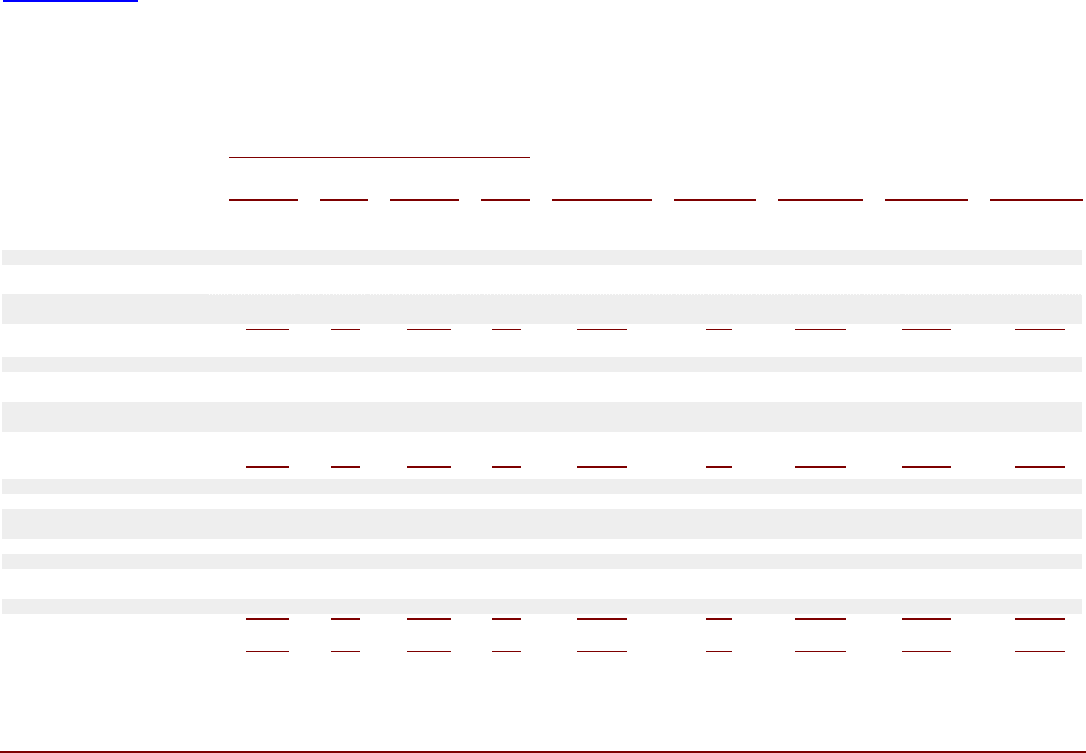

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

Accumulated

Common Stock Additional Other Retained

Paid in Comprehensi

ve Earnings Treasury

Shares Class A Shares Class B Capital Income (Deficit) Stock Total

(In thousands)

Balance at February 3, 2001

—

$

—

36,009 $ 36 $ (15,902) $

—

$ (4,744) $

—

$ (20,610)

Additional acquisition payments due

to former owners

—

—

—

—

9,665

—

—

—

9,665

Net earnings for the 52 weeks ended

February 2, 2002

—

—

—

—

—

—

6,960

—

6,960

Balance at February 2, 2002

—

—

36,009 36 (6,237)

—

2,216

—

(3,985)

Shares issued in public offering 20,764 21

—

—

347,318

—

—

—

347,339

Exercise of employee stock options

(including tax benefit of $1,906) 286

—

—

—

2,917

—

—

—

2,917

Capital contribution from Barnes &

Noble, Inc.

—

—

—

—

150,000

—

—

—

150,000

Net earnings for the 52 weeks ended

February 1, 2003

—

—

—

—

—

—

52,404

—

52,404

Balance at February 1, 2003 21,050 21 36,009 36 493,998

—

54,620

—

548,675

Comprehensive income:

Net earnings for the 52 weeks ended

January 31, 2004

—

—

—

—

—

—

63,467

—

Foreign currency translation

—

—

—

—

—

296

—

—

Total comprehensive income 63,763

Exercise of employee stock options

(including tax benefit of $9,702) 1,943 2

—

—

16,599

—

—

—

16,601

Treasury stock acquired, 2,304 shares

—

—

—

—

—

—

—

(35,006) (35,006)

Balance at January 31, 2004 22,993 $ 23 36,009 $ 36 $ 510,597 $ 296 $ 118,087 $ (35,006) $ 594,033

See accompanying notes to consolidated financial statements.

F-5