GameStop 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

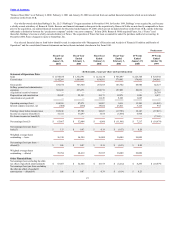

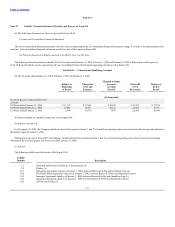

Predecessor

Fiscal Year Fiscal Year Fiscal Year Fiscal Year 13 Weeks 39 Weeks

Ended Ended Ended Ended Ended Ended

January 31, February 1, February 2, February 3, January 29, October 30,

2004 2003 2002 2001 2000 1999

(In thousands, except per share and operating data)

Store Operating Data:

Stores open at the end of period 1,514 1,231 1,038 978 526

Comparable store sales increase

(decrease)(5) 0.8 % 11.4% 32.0% (6.7)%

Inventory turnover 4.9 4.9 5.2 4.6

Balance Sheet Data:

Working capital (deficit) $ 188,902 $ 174,482 $ 31,107 $ (1,726) $ (28,849) $ (40,409)

Total assets 898,924 803,909 606,843 509,757 307,922 124,413

Total debt —

—

399,623 385,148 203,613

—

Total liabilities 304,891 255,234 610,828 530,367 316,571 140,279

Stockholders’ equity (deficit) 594,033 548,675 (3,985) (20,610) (8,649) (15,866)

(1) Prior to October 30, 1999, when Babbage’s was acquired by Barnes & Noble, Babbage’s was not subject to federal and most state income taxes, and its earnings

were taxed directly to its members. For the 39 weeks ended October 30, 1999, the financial statements include only a provision for state income taxes for those

states in which Babbage’s was taxed as a “C” corporation. For ease of comparison, provisions for state income taxes are included in the pro forma income tax

benefit, which is described in footnote (2). For periods after October 30, 1999, the financial statements reflect income tax expense (benefit) as if we were taxed as

a “C” corporation on a stand-alone basis.

(2) For the 39 weeks ended October 30, 1999, the pro forma income tax benefit reflects taxes as if we had been a “C” corporation in all jurisdictions and includes

certain state income taxes in the amount of $100.

(3) Net loss for the 39 weeks ended October 30, 1999 reflect pro forma taxes as described in footnote (2) above.

(4) Net earnings (loss) excluding the after-tax effect of goodwill amortization is presented here to provide additional information about our operations. These items

should be considered in addition to, but not as a substitute for or superior to, operating earnings, net earnings, cash flow and other measures of financial

performance prepared in accordance with generally accepted accounting principles. Note 6 of “Notes to Consolidated Financial Statements” of the Company

presents a reconciliation of net earnings to net earnings (loss) excluding the after-tax effect of goodwill amortization.

(5) Stores are included in our comparable store sales base beginning in the 13th month of operation. Comparable store sales for the fiscal year ended February 3,

2001 were computed using the first 52 weeks of the 53 week fiscal year.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in our consolidated financial statements, including the notes thereto.

Statements regarding future economic performance, management’s plans and objectives, and any statements concerning assumptions related to the foregoing contained

in Management’s Discussion and Analysis of Financial Condition and Results of Operations constitute forward-looking statements. Certain factors, which may cause

actual results to vary materially from these forward-looking statements, accompany such statements or appear elsewhere in this Form 10-K, including the factors

disclosed under “Business — Risk Factors.”

General

We are the largest specialty retailer of video game products and PC entertainment software in the United States, based on the number of U.S. retail stores we

operate and our total U.S. revenues. We sell new and used

22