GameStop 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

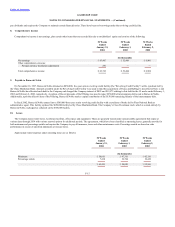

12. Income Taxes

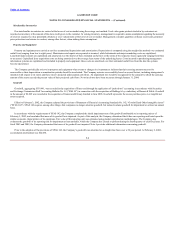

The provision for income tax consisted of the following:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands)

Current tax expense (benefit):

Federal $ 21,671 $ 22,945 $ 5,892

State 4,733 5,736 1,464

Foreign (98)

—

—

26,306 28,681 7,356

Deferred tax expense (benefit):

Federal 4,690 3,768 256

State 1,023 942 63

5,713 4,710 319

Charge in lieu of income taxes, relating to the tax effect of stock option tax

deduction 9,702 1,906

—

Total income tax expense $41,721 $35,297 $7,675

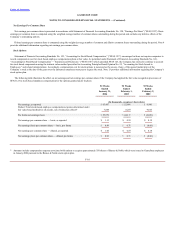

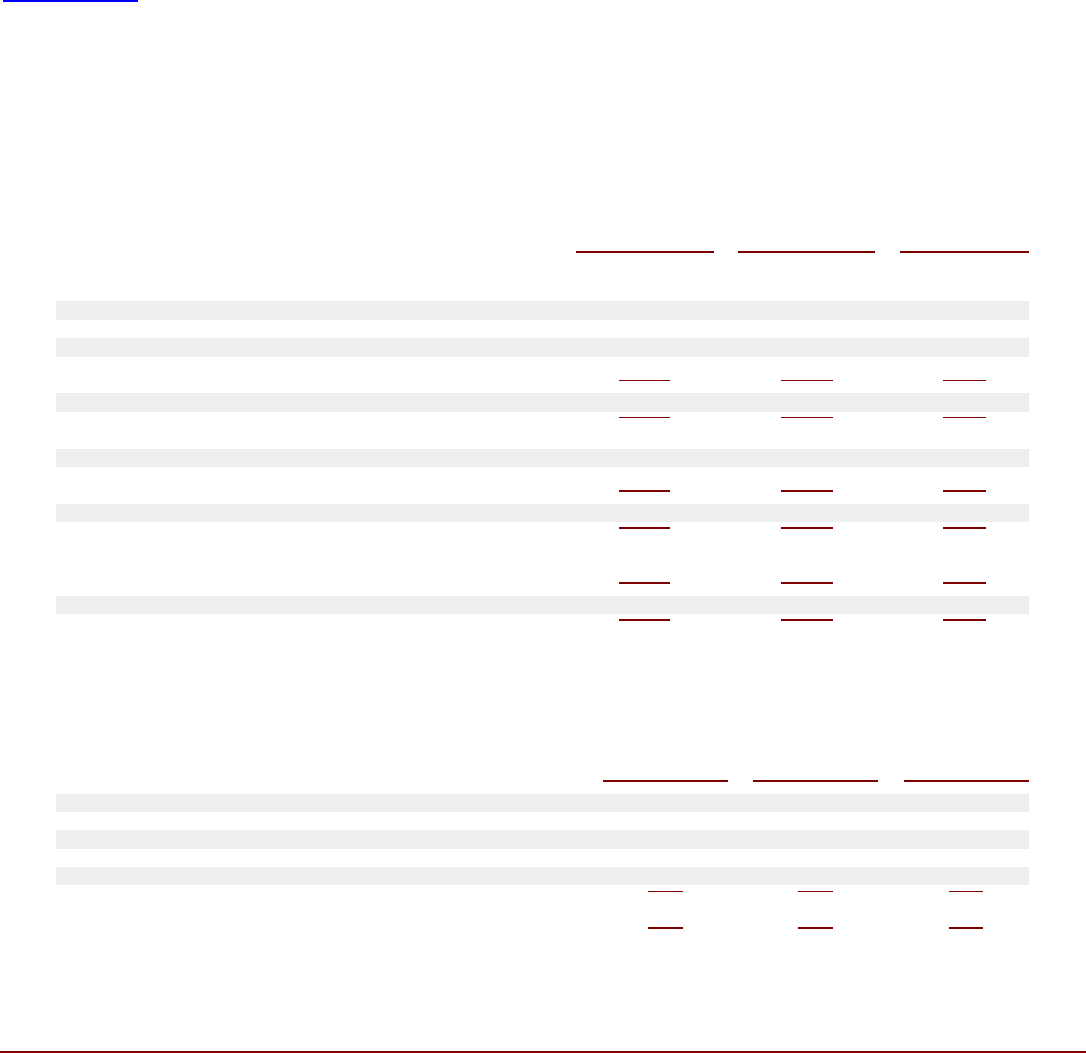

The difference in income tax provided and the amounts determined by applying the statutory rate to income before income taxes result from the following:

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

Federal statutory tax rate 35.0% 35.0% 35.0%

State income taxes, net of federal effect 4.6 5.2 6.8

Non-deductible goodwill amortization 0.0 0.0 10.5

Foreign income taxes (0.1) 0.0 0.0

Other (including permanent differences) 0.2 0.0 0.1

39.7% 40.2% 52.4%

Differences between financial accounting principles and tax laws cause differences between the bases of certain assets and liabilities for financial reporting

purposes and tax purposes. The tax effects of these

F-17