GameStop 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

products, in which case the cash consideration should be characterized as a reduction of that cost when recognized in the reseller’s income statement. Issue 2 states that

vendor rebates should be recognized on a systematic and rational allocation of the cash consideration offered to each of the underlying transactions that results in

progress by the reseller toward earning the rebate, provided the amounts are probable and reasonably estimable. Issue 1 is effective prospectively for all new

arrangements, including modifications of existing arrangements, entered into after December 31, 2002. Issue 2 is effective prospectively for all new arrangements

initiated after November 21, 2002.

The Company and its vendors participate in cooperative advertising programs and other vendor marketing programs in which the vendors provide the Company

with cash consideration in exchange for marketing and advertising the vendors’ products. The change of our accounting for cooperative advertising arrangements and

other vendor marketing programs resulted in a portion of the consideration received from our vendors reducing the product costs in inventory rather than as an offset to

our marketing and advertising costs as in prior years. The consideration serving as a reduction in inventory will be recognized in cost of sales as inventory is sold. The

amount of vendor allowances to be recorded as a reduction of inventory was determined by calculating the ratio of vendor allowances in excess of specific, incremental

and identifiable advertising and promotional costs to merchandise purchases. The Company then applied this ratio to the value of inventory in determining the amount

of vendor reimbursements to be recorded as a reduction to inventory reflected on the balance sheet.

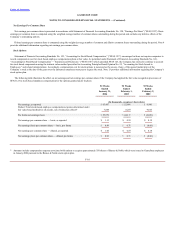

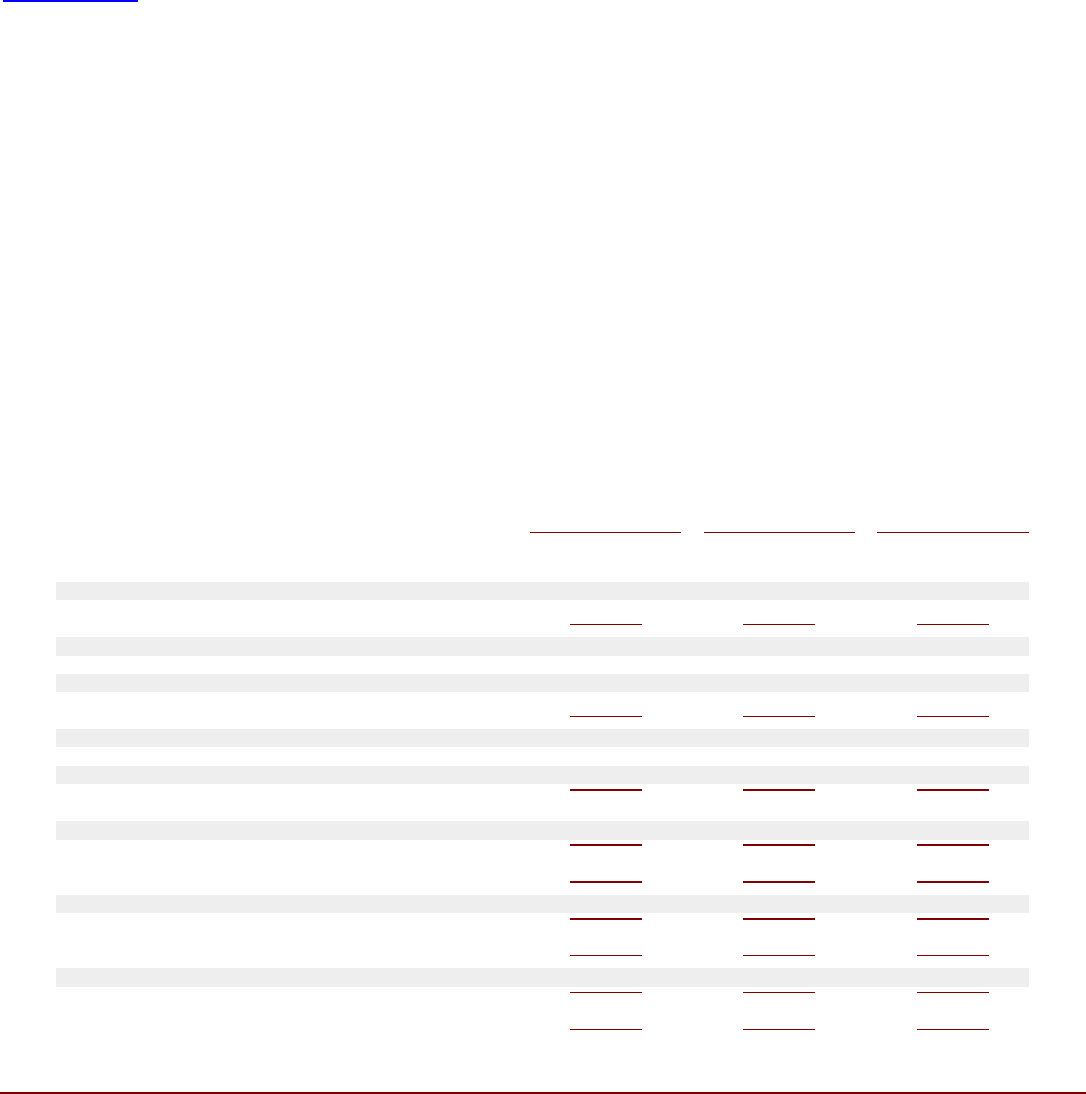

The impact of the new accounting method decreased our cost of sales for the 52 weeks ended January 31, 2004 by $21,569 and increased selling, general and

administrative expenses by $26,779. The impact to cost of sales reflects the reclassification of the cooperative advertising credit, as well as $5,210 deferred as a

reduction in inventory. Prior periods have not been restated. However, the following table presents the 52 weeks ended January 31, 2004, February 1, 2003 and

February 2, 2002 on a pro forma basis as if EITF 02-16 had been implemented prior to the beginning of fiscal 2001:

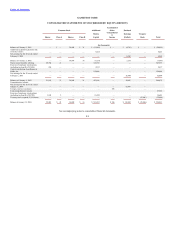

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 31, February 1, February 2,

2004 2003 2002

(In thousands, except per share data)

Sales $1,578,838 $1,352,791 $1,121,138

Cost of sales 1,138,596 984,530 833,748

Gross profit 440,242 368,261 287,390

Selling, general and administrative expenses 303,243 258,972 223,315

Depreciation and amortization 28,947 22,553 19,172

Amortization of goodwill —

—

11,125

Operating earnings 108,052 86,736 33,778

Interest income (1,467) (1,998) (123)

Interest expense 663 1,368 19,575

Earnings before income tax expense 108,856 87,366 14,326

Income tax expense 43,108 35,160 7,513

Net earnings $ 65,748 $ 52,206 $ 6,813

Net earnings per common share — basic $1.17 $0.93 $0.19

Weighted average shares of common stock — basic 56,330 56,289 36,009

Net earnings per common share — diluted $1.10 $0.86 $0.17

Weighted average shares of common stock — diluted 59,764 60,419 39,397

F-12