GameStop 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

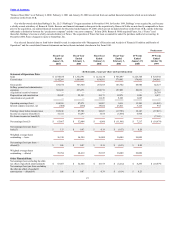

fiscal 2003. The decrease was attributable to the repayment of $250.0 million in debt in February 2002 using the proceeds of the Company’s February 2002 public

offering and the contribution of the remaining $150.0 million in debt to paid-in-capital by Barnes & Noble.

Income tax expense increased by $6.4 million, from $35.3 million in fiscal 2002 to $41.7 million in fiscal 2003. The Company’s effective tax rate decreased from

40.2% in fiscal 2002 to 39.7% in fiscal 2003 due primarily to tax-exempt interest income and state income tax credits, which are expected to recur. See Note 12 of

“Notes to Consolidated Financial Statements” of the Company for additional information regarding income taxes.

The factors described above led to an increase in operating earnings of $17.3 million, or 19.9%, from $87.1 million in fiscal 2002 to $104.4 million in fiscal 2003

and an increase in net earnings of $11.1 million, or 21.2%, from $52.4 million in fiscal 2002 to $63.5 million in fiscal 2003.

Fiscal 2002 Compared to Fiscal 2001

Sales increased by $231.7 million, or 20.7%, from $1,121.1 million in fiscal 2001 to $1,352.8 million in fiscal 2002. The increase in sales was primarily

attributable to an 11.4% increase in comparable store sales and the additional sales resulting from 210 new stores opened since February 2, 2002. The comparable store

sales increase was primarily due to sales of PlayStation 2, Xbox and GameCube hardware, software and accessories, following the launch of these new video game

platforms in October 2000 and November 2001, respectively, and the increase in sales of used video game products. The sales of these new hardware platforms and

related products were partially offset by sales declines in PlayStation, Nintendo 64, Dreamcast and PC entertainment software from the prior year.

Cost of sales increased by $155.5 million, or 18.2%, from $854.0 million in fiscal 2001 to $1,009.5 million in fiscal 2002. Cost of sales as a percentage of sales

decreased from 76.2% in fiscal 2001 to 74.6% in fiscal 2002. This decrease was the result of the shift in sales mix from lower margin video game hardware to higher

margin PlayStation 2, Game Boy Advance, Xbox and GameCube video game software and accessories and used video game products. Sales of new video game

hardware generally increase as a percentage of sales in the first full year following the introduction of next generation platforms. As video game platforms mature, the

sales mix attributable to complementary video game software and accessories, which generate higher gross margins, generally increases in the second and third years.

The net effect is generally a decline in gross margins in the first full year following new platform releases and an increase in gross margins in the second and third

years.

Selling, general and administrative expenses increased by $31.0 million, or 15.3%, from $202.7 million in fiscal 2001 to $233.7 million in fiscal 2002. The increase

was primarily attributable to the increase in the number of stores in operation and the related increases in store, distribution, and corporate office operating expenses.

Selling, general and administrative expenses as a percentage of sales decreased from 18.1% in fiscal 2001 to 17.3% in fiscal 2002. The decrease in selling, general and

administrative expenses as a percentage of sales was due to the economies achieved in distribution and corporate operating expenses and the store operating efficiencies

gained as a result of the increase in comparable store sales and an intense focus on expense controls.

Depreciation and amortization expense increased from $19.2 million for fiscal 2001 to $22.6 million in fiscal 2002. This increase of $3.4 million was due to the

capital expenditures for new stores, management information systems and distribution center enhancements during the fiscal year.

Amortization of goodwill was $11.1 million in fiscal 2001. In accordance with SFAS No. 142, the related goodwill was not amortized during fiscal 2002.

Interest expense, net of interest income, decreased by $20.1 million from $19.5 million of net interest expense in fiscal 2001 to net interest income of $0.6 million

in fiscal 2002. The decrease was attributable to the repayment of $250.0 million in debt in February 2002 using a portion of the proceeds of the public offering and the

contribution of the remaining $150.0 million in debt to additional paid-in-capital by Barnes & Noble. The interest income resulted from the investment of excess cash

balances.

26