GameStop 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

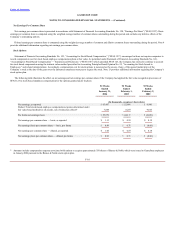

Merchandise Inventories

Our merchandise inventories are carried at the lower of cost or market using the average cost method. Used video game products traded in by customers are

recorded as inventory at the amount of the store credit given to the customer. In valuing inventory, management is required to make assumptions regarding the necessity

of reserves required to value potentially obsolete or over-valued items at the lower of cost or market. Management considers quantities on hand, recent sales, potential

price protections and returns to vendors, among other factors, when making these assumptions.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Depreciation is computed using the straight-line method over estimated

useful lives (ranging from two to eight years). Maintenance and repairs are expensed as incurred, while betterments and major remodeling costs are capitalized.

Leasehold improvements are capitalized and amortized over the shorter of their estimated useful lives or the terms of the respective leases (generally ranging from three

to ten years). Capitalized lease acquisition costs are being amortized over the average lease terms of the underlying leases. Costs incurred in purchasing management

information systems are capitalized and included in property and equipment; these costs are amortized over their estimated useful lives from the date the systems

become operational.

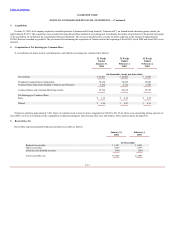

The Company periodically reviews its property and equipment when events or changes in circumstances indicate that their carrying amounts may not be

recoverable or their depreciation or amortization periods should be accelerated. The Company assesses recoverability based on several factors, including management’s

intention with respect to its stores and those stores’ projected undiscounted cash flows. An impairment loss would be recognized for the amount by which the carrying

amount of the assets exceeds the present value of their projected cash flows. No write-downs have been necessary through January 31, 2004.

Goodwill

Goodwill, aggregating $339,991, was recorded in the acquisition of Funco and through the application of “push-down” accounting in accordance with Securities

and Exchange Commission Staff Accounting Bulletin No. 54 (“SAB 54”) in connection with the acquisition of Babbage’s by a subsidiary of Barnes & Noble. Goodwill

in the amount of $2,869 was recorded in the acquisition of Gamesworld Group Limited in June 2003. Goodwill represents the excess purchase price over tangible net

assets acquired.

Effective February 3, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets”

(“SFAS 142”). SFAS 142 requires, among other things, that companies no longer amortize goodwill, but instead evaluate goodwill for impairment on at least an annual

basis.

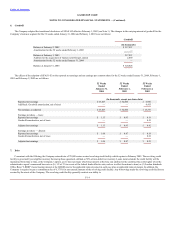

In accordance with the requirements of SFAS 142, the Company completed the initial impairment test of the goodwill attributable to its reporting unit as of

February 3, 2002, and concluded that none of its goodwill was impaired. As part of this analysis, the Company determined that it has one reporting unit based upon the

similar economic characteristics of its operations. Fair value of this reporting unit was estimated using market capitalization methodologies. The Company also

evaluates the goodwill of its reporting unit for impairment at least annually, which the Company has elected to perform during the fourth quarter of each fiscal year. For

fiscal 2003 and 2002, the Company determined that none of its goodwill was impaired. Note 6 provides additional information concerning goodwill.

Prior to the adoption of the provisions of SFAS 142, the Company’s goodwill was amortized on a straight-line basis over a 30-year period. At February 2, 2002,

accumulated amortization was $22,034.

F-8