Family Dollar 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

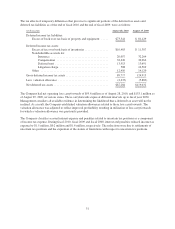

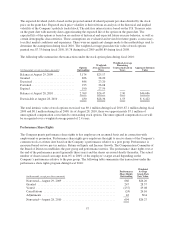

16. Unaudited Summaries of Quarterly Results:

(in thousands, except per share amounts)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2010

Net sales ....................................... $1,822,906 $2,090,230 $1,996,989 $1,956,846

Gross profit ..................................... 658,222 740,831 730,228 678,719

Net income ..................................... 67,621 112,209 104,351 73,954

Net income per common share(1) ..................... $ 0.49 $ 0.81 $ 0.77 $ 0.56

2009

Net sales ....................................... $1,753,833 $1,992,260 $1,843,089 $1,811,424

Gross profit ..................................... 614,453 671,304 667,192 625,256

Net income ..................................... 59,289 84,140 87,721 60,116

Net income per common share(1) ..................... $ 0.42 $ 0.60 $ 0.62 $ 0.43

(1) Figures represent diluted earnings per share. The sum of the quarterly net income per common share may

not equal the annual net income per common share due to rounding.

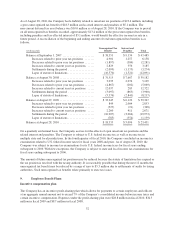

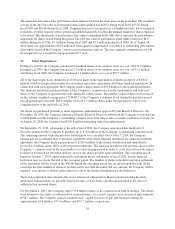

17. Related Party Transactions:

There were no material related party transactions during fiscal 2010 or fiscal 2009. Related party transactions

totaled approximately $0.8 million during fiscal 2008. The related party transactions during fiscal 2008 were for

Company purchases of merchandise in the ordinary course of business from entities owned or represented by

non-employee family members of the Company’s Chairman of the Board and Chief Executive Officer.

18. Subsequent Events:

On September 29, 2010, the Company announced that the Board of Directors authorized the Company to

purchase up to $750 million of the Company’s outstanding common stock. The remaining amount under the

previous authorization was cancelled. On October 5, 2010, the Company entered into an accelerated share

repurchase agreement with a large financial institution for $250.0 million. See Note 12 above for more

information.

61