Family Dollar 2010 Annual Report Download - page 48

Download and view the complete annual report

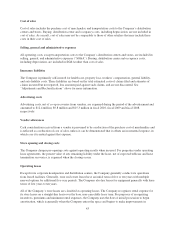

Please find page 48 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.preparation for intended use. For tenant improvement allowances and rent holidays, the Company records a

deferred rent liability at the inception of the lease term and amortizes the deferred rent over the terms of the

leases as reductions to rent expense on the Consolidated Statements of Income.

Certain leases provide for contingent rental payments based upon a percentage of store sales. The Company

accrues for contingent rental expense as it becomes probable that specified sales targets will be met.

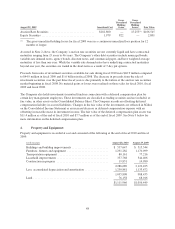

Capitalized interest

The Company capitalizes interest on borrowed funds during the construction of property and equipment. The

Company capitalized $0.8 million, $1.2 million and $0.8 million of interest costs during fiscal 2010, fiscal 2009

and fiscal 2008, respectively.

Income taxes

The Company records deferred income tax assets and liabilities for the expected future tax consequences of

temporary differences between the financial reporting bases and the income tax bases of its assets and liabilities.

The Company estimates contingent income tax liabilities based on an assessment of the probability of the

income-tax-related exposures and settlements related to uncertain tax positions. See Note 8 for more information

on the Company’s income taxes.

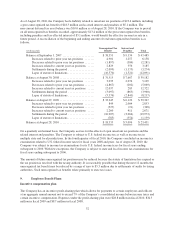

Stock-based compensation

The Company recognizes compensation expense related to its stock-based awards based on the fair value of the

awards on the grant date. The Company utilizes the Black-Scholes option-pricing model to estimate the grant-

date fair value of its stock option awards. The grant-date fair value of the Company’s performance share rights

awards is based on the stock price on the grant date. Compensation expense for the Company’s stock-based

awards is recognized on a straight-line basis, net of estimated forfeitures, over the service period of each

award. See Note 11 for more information on the Company’s stock-based compensation plans.

New accounting pronouncements

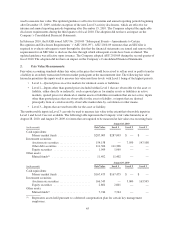

In June 2009, the Financial Accounting Standards Board (“FASB”) issued a new accounting standard which

established the FASB Accounting Standards Codification (“ASC”) as the source of authoritative accounting

principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial

statements in conformity with generally accepted accounting principles (“GAAP”). Rules and interpretive

releases of the Securities and Exchange Commission (“SEC”) under authority of federal securities laws are also

considered sources of authoritative GAAP for SEC registrants. The ASC combines all non-SEC authoritative

standards into a comprehensive database organized by topic. The ASC is effective for interim and annual periods

ending after September 15, 2009. The Company adopted the ASC during the first quarter of fiscal 2010. The

adoption of the ASC did not have an impact on the Company’s Consolidated Financial Statements.

In September 2006, the FASB issued fair value guidance (ASC 820) that defines fair value, establishes a framework

for measuring fair value in GAAP and expands disclosures about fair value measurements. The Company adopted

the guidance with respect to financial assets and liabilities during the first quarter of fiscal 2009. The guidance

became effective for non-financial assets and liabilities for the first annual period beginning after November 15,

2008. The Company adopted the fair value guidance for non-financial assets and liabilities during the first quarter of

fiscal 2010. The adoption did not have an impact on the Company’s Consolidated Financial Statements.

In January 2010, the FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Fair Value

Measurements and Disclosures—Improving Disclosures about Fair Value Measurements” (“ASU 2010-06”).

ASU 2010-06 requires new disclosures for significant transfers in and out of Level 1 and 2 of the fair value

hierarchy and the activity within Level 3 of the fair value hierarchy. The updated guidance also clarifies existing

disclosures regarding the level of disaggregation of assets or liabilities and the valuation techniques and inputs

44