Family Dollar 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

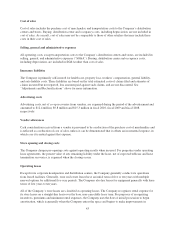

used to measure fair value. The updated guidance is effective for interim and annual reporting periods beginning

after December 15, 2009, with the exception of the new Level 3 activity disclosures, which are effective for

interim and annual reporting periods beginning after December 15, 2010. The Company adopted the applicable

disclosure requirements during the third quarter of fiscal 2010. The adoption did not have an impact on the

Company’s Consolidated Financial Statements.

In February 2010, the FASB issued ASU No. 2010-09 “Subsequent Events—Amendments to Certain

Recognition and Disclosure Requirements” (“ASU 2010-09”). ASU 2010-09 reiterates that an SEC filer is

required to evaluate subsequent events through the date that the financial statements are issued and removes the

requirement for an SEC filer to disclose the date through which subsequent events have been evaluated. The

updated guidance was effective upon issuance. The Company adopted ASU 2010-09 during the second quarter of

fiscal 2010. The adoption did not have an impact on the Company’s Consolidated Financial Statements.

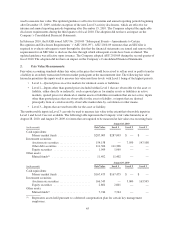

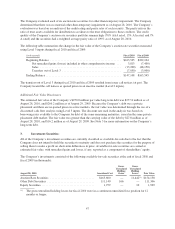

2. Fair Value Measurements:

Fair value accounting standards define fair value as the price that would be received to sell an asset or paid to transfer

a liability in an orderly transaction between market participants at the measurement date. The following fair value

hierarchy prioritizes the inputs used to measure fair value into three levels, with Level 1 being of the highest priority.

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Inputs other than quoted prices included within Level 1 that are observable for the asset or

liability, either directly or indirectly, such as quoted prices for similar assets or liabilities in active

markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs

other than quoted prices that are observable for the asset or liability, or inputs that are derived

principally from or corroborated by observable market data by correlation or other means.

• Level 3—Inputs that are unobservable for the asset or liability.

The unobservable inputs in Level 3 can only be used to measure fair value to the extent that observable inputs in

Level 1 and Level 2 are not available. The following table represents the Company’s fair value hierarchy as of

August 28, 2010, and August 29, 2009, for items that are required to be measured at fair value on a recurring basis:

August 28, 2010

(in thousands) Fair Value Level 1 Level 2 Level 3

Cash equivalents:

Money market funds ...................... $287,003 $287,003 $ — $ —

Investment securities:

Auction rate securities ..................... 154,158 — 7,050 147,108

Other debt securities ...................... 111,306 111,306 — —

Equity securities ......................... 1,969 1,969 — —

Other assets:

Mutual funds(1) .......................... 11,402 11,402 — —

August 29, 2009

(in thousands) Fair Value Level 1 Level 2 Level 3

Cash equivalents:

Money market funds ...................... $167,475 $167,475 $ — $ —

Investment securities:

Auction rate securities ..................... 166,545 — 3,000 163,545

Equity securities ......................... 2,801 2,801 — —

Other assets:

Mutual funds(1) .......................... 7,744 7,744 — —

(1) Represents assets held pursuant to a deferred compensation plan for certain key management

employees.

45