Family Dollar 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

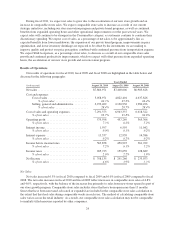

The following table shows our other commercial commitments at the end of fiscal 2010:

Other Commercial Commitments (in thousands)

Total Amounts

Committed

Standby letters of credit .......................................... $153,882

Surety bonds ................................................... 3,419

Total ......................................................... $157,301

A substantial portion of the outstanding amount of standby letters of credit (which are primarily renewed on

an annual basis) is used as surety for future premium and deductible payments to our workers’ compensation and

general liability insurance carrier. We accrue for these future payment liabilities as described in the “Critical

Accounting Policies” section of this discussion.

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) issued a new accounting standard which

established the FASB Accounting Standards Codification (“ASC”) as the source of authoritative accounting

principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial

statements in conformity with generally accepted accounting principles (“GAAP”). Rules and interpretive

releases of the SEC under authority of federal securities laws are also considered sources of authoritative GAAP

for SEC registrants. The ASC combines all non-SEC authoritative standards into a comprehensive database

organized by topic. The ASC is effective for interim and annual periods ending after September 15, 2009. We

adopted the ASC during the first quarter of fiscal 2010. The adoption of the ASC did not have an impact on our

Consolidated Financial Statements.

In September 2006, the FASB issued fair value guidance (ASC 820) that defines fair value, establishes a

framework for measuring fair value in GAAP and expands disclosures about fair value measurements. We

adopted the guidance with respect to financial assets and liabilities during the first quarter of fiscal 2009. The

guidance became effective for non-financial assets and liabilities for the first annual period beginning after

November 15, 2008. We adopted the fair value guidance for non-financial assets and liabilities during the first

quarter of fiscal 2010. The adoption did not have an impact on our Consolidated Financial Statements.

In January 2010, the FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Fair Value

Measurements and Disclosures—Improving Disclosures about Fair Value Measurements” (“ASU 2010-06”). ASU

2010-06 requires new disclosures for significant transfers in and out of Level 1 and 2 of the fair value hierarchy and

the activity within Level 3 of the fair value hierarchy. The updated guidance also clarifies existing disclosures

regarding the level of disaggregation of assets or liabilities and the valuation techniques and inputs used to measure

fair value. The updated guidance is effective for interim and annual reporting periods beginning after December 15,

2009, with the exception of the new Level 3 activity disclosures, which are effective for interim and annual

reporting periods beginning after December 15, 2010. We adopted the applicable disclosure requirements during the

third quarter of fiscal 2010. The adoption did not have an impact on our Consolidated Financial Statements.

In February 2010, the FASB issued ASU No. 2010-09 “Subsequent Events—Amendments to Certain

Recognition and Disclosure Requirements” (“ASU 2010-09”). ASU 2010-09 reiterates that an SEC filer is

required to evaluate subsequent events through the date that the financial statements are issued and removes the

requirement for an SEC filer to disclose the date through which subsequent events have been evaluated. The

updated guidance was effective upon issuance. We adopted ASU 2010-09 during the second quarter of fiscal

2010. The adoption did not have an impact on our Consolidated Financial Statements.

Critical Accounting Policies

Our financial statements have been prepared in accordance with accounting policies generally accepted in

the United States of America. Our discussion and analysis of our financial condition and results of operations are

based on these financial statements. The preparation of these financial statements requires the application of

30