Family Dollar 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

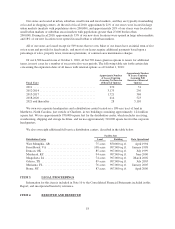

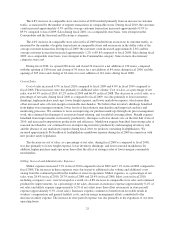

Our common stock is traded on the New York Stock Exchange under the ticker symbol FDO. At October 1,

2010, there were approximately 2,740 holders of record of our common stock. The accompanying tables give the

high and low sales prices of our common stock and the dividends declared per share for each quarter of fiscal

2010 and fiscal 2009. We expect that dividends will continue to be declared quarterly for the foreseeable future.

Market Prices and Dividends

2010 High Low Dividend

First Quarter ......................................................... $31.63 $25.52 $.13 1/2

Second Quarter ....................................................... 33.57 27.15 .15 1/2

Third Quarter ........................................................ 42.07 32.30 .15 1/2

Fourth Quarter ....................................................... 44.03 35.31 .15 1/2

2009 High Low Dividend

First Quarter ......................................................... $32.50 $19.70 $.12 1/2

Second Quarter ....................................................... 29.47 21.79 .13 1/2

Third Quarter ........................................................ 35.00 26.06 .13 1/2

Fourth Quarter ....................................................... 32.97 27.50 .13 1/2

Issuer Purchases of Equity Securities

The following table sets forth information with respect to purchases of shares of our common stock made

during the quarter ended August 28, 2010, by us, on our behalf or by any “affiliated purchaser” as defined by

Rule 10b-18(a)(3) of the Exchange Act.

Period

Total Number

of Shares

Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs(1)

Maximum Number

of Shares that May

Yet Be Purchased

Under the Plans or

Programs(1)(2)

June (5/30/10-7/3/10) .................. 524,100 $38.84 524,100 4,927,181

July (7/4/10-7/31/10) .................. 775,331 38.24 775,331 4,601,880

August (8/1/10-8/28/10) ................ 1,435,136 42.16 1,435,136 2,994,418

Total ........................... 2,734,567 $40.41 2,734,567 2,994,418

(1) On November 18, 2009, we announced that the Board of Directors authorized the purchase of up to $400

million of our outstanding common stock from time to time as market conditions warrant. As of August 28,

2010, there was $129.8 million remaining under this authorization.

(2) Remaining dollar amounts are converted to shares using the closing stock price as of the end of the fiscal

month.

The stock repurchases in the table above include both open market purchases and purchases made in

connection with structured repurchase agreements. See Note 12 to the Consolidated Financial Statements

included in this Report for more information.

On September 29, 2010, subsequent to the end of fiscal 2010, we announced that the Board of Directors

authorized the purchase of up to $750 million of our outstanding common stock. The remaining amount under

the previous authorization was cancelled. On October 5, 2010, we entered into an accelerated share repurchase

agreement with a large financial institution for $250.0 million. See Note 12 to the Consolidated Financial

Statements included in this Report for more information.

19