Family Dollar 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

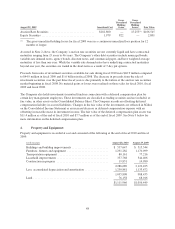

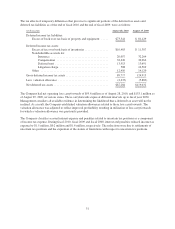

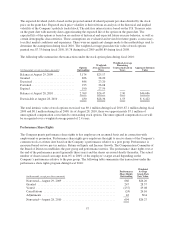

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities as of the end of fiscal 2010 and the end of fiscal 2009, were as follows:

(in thousands) August 28, 2010 August 29, 2009

Deferred income tax liabilities:

Excess of book over tax basis of property and equipment ..... $73,341 $ 81,129

Deferred income tax assets:

Excess of tax over book basis of inventories ................ $10,403 $ 11,307

Nondeductible accruals for:

Insurance ....................................... 20,057 32,264

Compensation ................................... 32,426 36,964

Deferred rent .................................... 13,913 13,691

Litigation charge ................................. 508 16,569

Other .............................................. 12,410 14,120

Gross deferred income tax assets ............................. 89,717 124,915

Less: valuation allowance .................................. (2,433) (5,883)

Net deferred tax assets ..................................... $87,284 $119,032

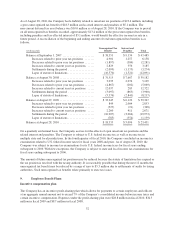

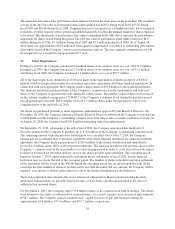

The Company had net operating loss carryforwards of $95.6 million as of August 28, 2010, and $153.1 million as

of August 29, 2009, in various states. These carryforwards expire at different intervals up to fiscal year 2030.

Management considers all available evidence in determining the likelihood that a deferred tax asset will not be

realized. As a result, the Company established valuation allowances related to these loss carryforwards. The

valuation allowance was adjusted to reflect improved profitability resulting in utilization of loss carryforwards

for which a valuation allowance was previously provided.

The Company classifies accrued interest expense and penalties related to uncertain tax positions as a component

of income tax expense. During fiscal 2010, fiscal 2009 and fiscal 2008, interest and penalties reduced income tax

expense by $1.5 million, $0.2 million and $1.4 million, respectively. The reductions were due to settlements of

uncertain tax positions and the expiration of the statute of limitations with respect to uncertain tax positions.

51