Family Dollar 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

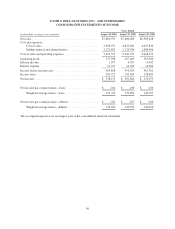

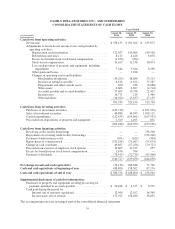

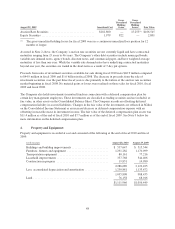

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended

(in thousands)

August 28,

2010

August 29,

2009

August 30,

2008

Cash flows from operating activities:

Net income ............................................. $358,135 $ 291,266 $ 233,073

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization .......................... 172,037 159,808 149,598

Deferred income taxes ................................. 8,123 4,426 6,878

Excess tax benefits from stock-based compensation ......... (1,676) (704) —

Stock-based compensation ............................. 13,163 11,538 10,073

Loss on disposition of property and equipment, including

impairment ....................................... 7,244 9,924 6,298

Other gains and losses ................................. — 1,228 —

Changes in operating assets and liabilities:

Merchandise inventories ........................... (34,225) 38,888 33,213

Income tax refund receivable ....................... 8,618 (1,611) 37,387

Prepayments and other current assets ................. 200 238 (6,088)

Other assets ..................................... 2,666 6,027 (4,714)

Accounts payable and accrued liabilities .............. 57,405 13,798 21,415

Income taxes .................................... 16,771 210 1,466

Other liabilities .................................. (16,922) (5,837) 27,139

591,539 529,199 515,738

Cash flows from investing activities:

Purchases of investment securities ........................... (142,730) — (1,071,570)

Sales of investment securities ............................... 46,888 44,943 1,039,115

Capital expenditures ...................................... (212,435) (155,401) (167,932)

Proceeds from dispositions of property and equipment ........... 1,329 1,103 831

(306,948) (109,355) (199,556)

Cash flows from financing activities:

Revolving credit facility borrowings ......................... — — 736,300

Repayment of revolving credit facility borrowings .............. — — (736,300)

Payment of debt issuance costs .............................. (651) (624) (304)

Repurchases of common stock .............................. (332,189) (71,067) (97,674)

Change in cash overdrafts .................................. 49,687 (27,256) (79,727)

Proceeds from exercise of employee stock options .............. 19,663 31,525 257

Excess tax benefits from stock-based compensation ............. 1,676 704 —

Payment of dividends ..................................... (78,913) (72,738) (67,408)

(340,727) (139,456) (244,856)

Net change in cash and cash equivalents ......................... (56,136) 280,388 71,326

Cash and cash equivalents at beginning of year ................... 438,890 158,502 87,176

Cash and cash equivalents at end of year ........................ $382,754 $ 438,890 $ 158,502

Supplemental disclosures of cash flow information:

Purchases of property and equipment awaiting processing for

payment, included in accounts payable ...................... $ 22,848 $ 4,575 $ 6,579

Cash paid during the period for:

Interest, net of amounts capitalized ....................... 12,568 12,192 14,340

Income taxes, net of refunds ............................ 175,915 158,486 58,891

The accompanying notes are an integral part of the consolidated financial statements.

39