Family Dollar 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and $34.7 million non-current) as of the end of fiscal 2010 and $45.5 million ($4.0 million current and $41.5 million

non-current) as of the end of fiscal 2009. The current portion of the assets is included in prepayments and other

current assets on the Consolidated Balance Sheets, and the non-current portion is included in other assets.

In addition to the adjustments noted above, certain prior year amounts have been reclassified to conform to the

current year presentation. The Company’s long-term income tax liabilities related to uncertain tax positions, which

were previously broken out as a separate line on the Consolidated Balance Sheets, have been reclassified and

included in other liabilities.

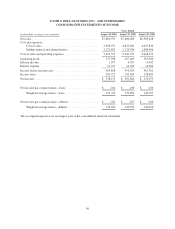

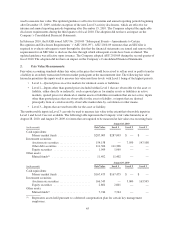

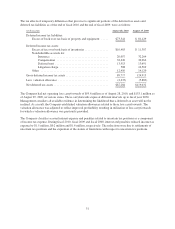

The adjustments and reclassifications to the Consolidated Balance Sheet as of the end of fiscal 2009 are

summarized in the table below.

(in thousands)

As Reported

August 29, 2009

Adjustments and

Reclassifications

Revised

August 29, 2009

Assets

Deferred income taxes ...................... $ 93,164 $ (10,457) $ 82,707

Prepayments and other current assets ........... $ 59,168 $ 4,037 $ 63,205

Total current assets ......................... $1,599,438 $ (6,420) $1,593,018

Other assets ............................... $ 23,290 $ 41,500 $ 64,790

Total assets .............................. $2,842,722 $ 35,080 $2,877,802

Liabilities

Accrued liabilities ......................... $ 529,927 $(153,412) $ 376,515

Total current liabilities ...................... $1,059,707 $(153,412) $ 906,295

Other liabilities ............................ $ — $236,643 $ 236,643

Deferred income taxes ...................... $ 55,261 $ (10,457) $ 44,804

Income taxes .............................. $ 37,694 $ (37,694) $ —

Total liabilities ........................... $1,402,662 $ 35,080 $1,437,742

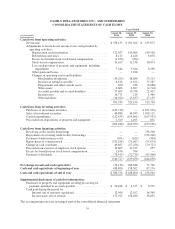

Cash equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash

equivalents. The carrying amount of the Company’s cash equivalents approximates fair value due to the short

maturities of these investments and consists primarily of money market funds and other overnight

investments. The Company maintains cash deposits with major banks, which from time to time may exceed

federally insured limits. The Company periodically assesses the financial condition of the institutions and

believes that the risk of any loss is minimal. Payments due from banks for third-party credit card, debit card and

electronic benefit transactions are generally processed within 24-72 hours and are classified as cash equivalents.

The Company maintains zero balance cash disbursement accounts with certain banks. Outstanding checks in

excess of funds on deposit with respect to these banks, referred to as cash overdrafts, are classified as accounts

payable on the Consolidated Balance Sheets, and totaled $49.7 million at the end of fiscal 2010. There were no

cash overdrafts at the end of fiscal 2009. Changes in these overdraft amounts are recorded as financing activities

on the Consolidated Statements of Cash Flows.

The Company’s wholly-owned captive insurance subsidiary maintains balances in cash and cash equivalents that

are used in connection with the Company’s retained workers’ compensation, general liability and automobile

liability risks and are not designated for general corporate purposes. These cash and cash equivalents balances

totaled $42.1 million as of the end of fiscal 2010 and $58.6 million as of the end of fiscal 2009.

Investment securities

The Company classifies all investment securities as available-for-sale. Securities accounted for as

available-for-sale are required to be reported at fair value with unrealized gains and losses, net of taxes, excluded

41