Family Dollar 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

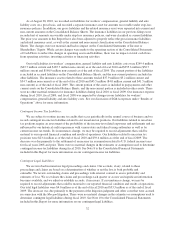

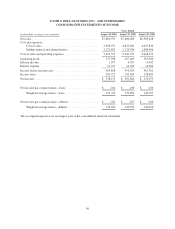

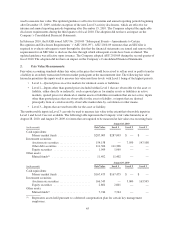

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share and share amounts)

August 28,

2010

August 29,

2009

Assets

Current assets:

Cash and cash equivalents ........................................ $ 382,754 $ 438,890

Investment securities ............................................ 120,325 5,801

Merchandise inventories ......................................... 1,028,022 993,797

Deferred income taxes ........................................... 66,102 82,707

Income tax refund receivable ..................................... — 8,618

Prepayments and other current assets ............................... 63,005 63,205

Total current assets ......................................... 1,660,208 1,593,018

Property and equipment, net .......................................... 1,111,966 1,056,449

Investment securities ................................................ 147,108 163,545

Other assets ....................................................... 62,775 64,790

Total assets ....................................................... $ 2,982,057 $ 2,877,802

Liabilities and Shareholders’ Equity

Current liabilities:

Accounts payable .............................................. $ 676,975 $ 528,104

Accrued liabilities .............................................. 359,065 376,515

Income taxes .................................................. 18,447 1,676

Total current liabilities ...................................... 1,054,487 906,295

Long-term debt .................................................... 250,000 250,000

Other liabilities .................................................... 203,857 236,643

Deferred income taxes ............................................... 52,159 44,804

Commitments and contingencies (Note 10)

Shareholders’ equity:

Preferred stock, $1 par; authorized and unissued 500,000 shares ..........

Common stock, $.10 par; authorized 600,000,000 shares; issued

146,496,237 shares at August 28, 2010, and 145,485,734 shares at

August 29, 2009, and outstanding 130,452,959 shares at August 28,

2010, and 138,795,832 shares at August 29, 2009 ................... 14,650 14,549

Capital in excess of par .......................................... 243,831 210,349

Retained earnings .............................................. 1,665,646 1,387,905

Accumulated other comprehensive loss ............................. (7,046) (8,960)

1,917,081 1,603,843

Less: common stock held in treasury, at cost (16,043,278 shares at August

28, 2010, and 6,689,902 shares at August 29, 2009) ................. 495,527 163,783

Total shareholders’ equity .................................... 1,421,554 1,440,060

Total liabilities and shareholders’ equity ................................ $ 2,982,057 $ 2,877,802

The accompanying notes are an integral part of the consolidated financial statements.

37