Family Dollar 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

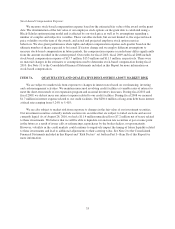

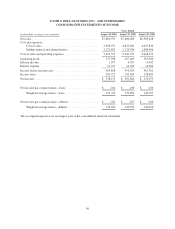

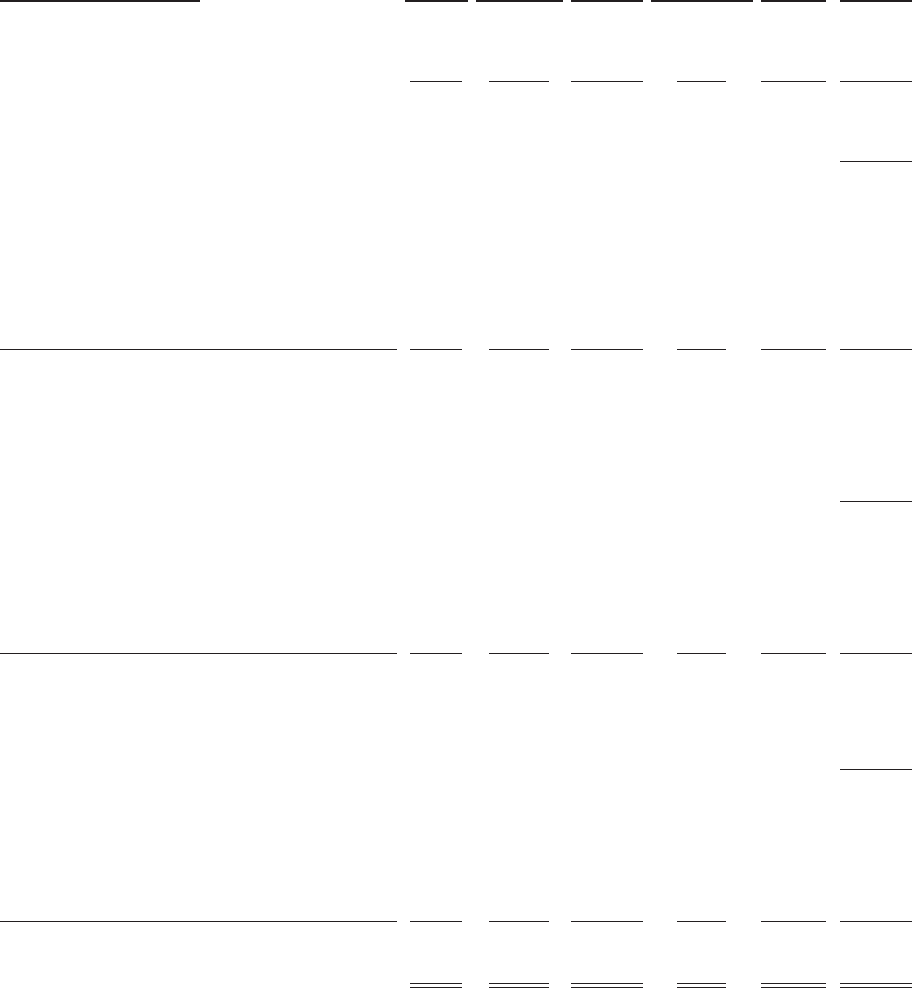

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years Ended August 28, 2010, August 29, 2009, and August 30, 2008

(in thousands, except per share

and share amounts)

Common

stock

Capital in

excess of par

Retained

earnings

Accumulated

other

comprehensive

loss

Treasury

stock Total

Balance, September 1, 2007

(179,886,234 shares common stock;

36,541,942 shares treasury stock) .................. $17,989 $187,855 $1,722,859 $ — $(754,062) $1,174,641

ASC 740 Adoption .................................. 912 912

Balance as adjusted, September 1, 2007 ................. 17,989 187,855 1,723,771 — (754,062) 1,175,553

Net income for the year .............................. 233,073 233,073

Unrealized loss on investment securities

(net of $3.0 million of taxes) ........................ (4,862) (4,862)

Comprehensive income .............................. 228,211

Issuance of 65,014 common shares under

incentive plans, including tax benefits ................. 6 201 207

Purchase of 3,719,054 common shares for treasury ........ (97,674) (97,674)

Issuance of 14,290 shares of treasury under

incentive plan (Director compensation) ................ (56) 302 246

Retirement of 35,818,927 shares of

treasury stock .................................... (3,582) (37,408) (717,655) 758,645 —

Stock-based compensation ............................ 16,077 16,077

Dividends on common stock, $.49 per share .............. (68,537) (68,537)

Balance, August 30, 2008

(139,704,542 shares common stock;

4,427,779 shares treasury stock) ................... 14,413 166,669 1,170,652 (4,862) (92,789) 1,254,083

Net income for the year .............................. 291,266 291,266

Unrealized gains (losses) on investment securities

(net of $2.5 million of taxes) ........................ (4,626) (4,626)

Reclassification adjustment for (gains) losses

realized in net income (net of $0.3 million of taxes) ...... 528 528

Comprehensive income .............................. 287,168

Issuance of 1,353,413 common shares

under incentive plans, including tax benefits ............ 136 31,450 31,586

Purchase of 2,271,528 common shares for treasury ........ (71,067) (71,067)

Issuance of 9,405 shares of treasury stock

under incentive plans (Director compensation) .......... 197 73 270

Stock-based compensation ............................ 12,033 12,033

Dividends on common stock, $.53 per share .............. (74,013) (74,013)

Balance, August 29, 2009

(138,795,832 shares common stock;

6,689,902 shares treasury stock) ................... 14,549 210,349 1,387,905 (8,960) (163,783) 1,440,060

Net income for the year .............................. 358,135 358,135

Unrealized gains (losses) on investment securities

(net of $1.2 million of taxes) ........................ 1,914 1,914

Comprehensive income .............................. 360,049

Issuance of 1,010,503 common shares

under incentive plans, including tax benefits ............ 101 21,045 21,146

Purchase of 9,370,908 common shares for treasury ........ (332,189) (332,189)

Issuance of 17,532 shares of treasury stock

under incentive plans (Director compensation) .......... 95 445 540

Stock-based compensation ............................ 12,342 12,342

Dividends on common stock, $.60 per share .............. (80,394) (80,394)

Balance, August 28, 2010

(130,452,959 shares common stock;

16,043,278 shares treasury stock) .................. $14,650 $243,831 $1,665,646 $(7,046) $(495,527) $1,421,554

The accompanying notes are an integral part of the consolidated financial statements.

38