Family Dollar 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of August 28, 2010, we recorded our liabilities for workers’ compensation, general liability and auto

liability costs on a gross basis, and recorded a separate insurance asset for amounts recoverable under stop-loss

insurance policies. In addition, our gross liabilities and the related insurance asset were separated into current and

non-current amounts on the Consolidated Balance Sheets. The insurance liabilities in our previous filings were

recorded net of amounts recoverable under stop-loss insurance policies, and were classified as current liabilities.

The prior year amounts in this Report have also been adjusted to properly reflect the gross insurance liabilities

and related insurance asset, as well as the current and non-current classification on the Consolidated Balance

Sheets. The changes were not material and had no impact on the Consolidated Statements of Income or

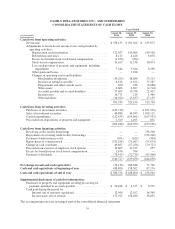

Shareholders’ Equity. While certain changes were made to the operating section of the Consolidated Statements

of Cash Flows to reflect the changes in operating assets and liabilities, there was no impact on total cash flows

from operating activities, investing activities or financing activities.

Our total liabilities for workers’ compensation, general liability and auto liability costs were $249.4 million

($63.7 million current and $185.7 million non-current) as of the end of fiscal 2010 and $255.6 million ($56.7

million current and $198.9 million non-current) as of the end of fiscal 2009. The current portion of the liabilities

is included in accrued liabilities on the Consolidated Balance Sheets, and the non-current portion is included in

other liabilities. The insurance assets related to these amounts totaled $37.9 million ($3.2 million current and

$34.7 million non-current) as of the end of fiscal 2010 and $45.5 million ($4.0 million current and $41.5 million

non-current) as of the end of fiscal 2009. The current portion of the assets is included in prepayments and other

current assets on the Consolidated Balance Sheets, and the non-current portion is included in other assets. There

were no other material estimates for insurance liabilities during fiscal 2010 or fiscal 2009. Our insurance expense

during fiscal 2010, fiscal 2009, and fiscal 2008 was impacted by changes in our liabilities for workers’

compensation, general liability and auto liability costs. See our discussion of SG&A expenses under “Results of

Operations” above for more information.

Contingent Income Tax Liabilities:

We are subject to routine income tax audits that occur periodically in the normal course of business and we

record contingent income tax liabilities related to our uncertain tax positions. Our liabilities related to uncertain

tax positions require an assessment of the probability of the income-tax-related exposures and settlements and are

influenced by our historical audit experiences with various state and federal taxing authorities as well as by

current income tax trends. If circumstances change, we may be required to record adjustments that could be

material to our reported financial condition and results of operations. Our liabilities related to uncertain tax

positions were $23.4 million as of the end of fiscal 2010 and $39.4 million as of the end of fiscal 2009. The

decrease was due primarily to the settlement of an income tax examination related to U.S. federal income taxes

for fiscal years 2008 and prior. There were no material changes in the estimates or assumptions used to determine

contingent income tax liabilities during fiscal 2010. See Note 8 to the Consolidated Financial Statements

included in this Report for more information on our contingent income tax liabilities.

Contingent Legal Liabilities:

We are involved in numerous legal proceedings and claims. Our accruals, if any, related to these

proceedings and claims are based on a determination of whether or not the loss is both probable and

estimable. We review outstanding claims and proceedings with external counsel to assess probability and

estimates of loss. We re-evaluate the claims and proceedings each quarter or as new and significant information

becomes available, and we adjust or establish accruals, if necessary. If circumstances change, we may be

required to record adjustments that could be material to our reported financial condition and results of operations.

Our total legal liabilities were $4.0 million as of the end of fiscal 2010 and $53.3 million as of the end of fiscal

2009. The decrease was due primarily to the payment of the litigation judgment and other costs that were accrued

in connection with the Morgan litigation. There were no material changes in the estimates or assumptions used to

determine contingent legal liabilities during fiscal 2010. See Note 10 to the Consolidated Financial Statements

included in this Report for more information on our contingent legal liabilities.

32