Family Dollar 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

money damages, recovery of attorneys’ fees and equitable relief. The case has been transferred to the N.C.

Federal Court. Presently, there are 48 named plaintiffs in the Scott case, with no additional opt-ins. The Company

is vigorously defending the allegations in the Scott case. The Company cannot reasonably estimate the possible

loss or range of loss that may result from this action.

The Company is involved in numerous other legal proceedings and claims incidental to its business, including

litigation related to alleged failures to comply with various state and federal employment laws, some of which are

or may be pled as class or collective actions, and litigation related to alleged personal or property damage, as to

which the Company carries insurance coverage and/or has established accrued liabilities as set forth in the

Company’s financial statements. While the ultimate outcome cannot be determined, the Company currently

believes that these proceedings and claims, both individually and in the aggregate, should not have a material

adverse effect on the Company’s financial position, liquidity or results of operations. However, the outcome of

any litigation is inherently uncertain and, if decided adversely to the Company, or, if the Company determines

that settlement of such actions is appropriate, the Company may be subject to liability that could have a material

adverse effect on the Company’s financial position, liquidity or results of operations.

11. Stock-Based Compensation:

The Family Dollar Stores, Inc. 2006 Incentive Plan (the “2006 Plan”) permits the granting of a variety of

compensatory award types. The Company currently grants non-qualified stock options and performance share

rights under the 2006 Plan. Shares issued related to stock options and performance share rights represent new

issuances of common stock. A total of 12.0 million common shares are reserved and available for issuance under

the 2006 Plan, plus any shares awarded under the Company’s previous plan (1989 Non-Qualified Stock Option

Plan) that expire or are canceled or forfeited after the adoption of the 2006 Plan. As of August 28, 2010, there

were 10.6 million shares remaining available for grant under the 2006 Plan. The Company also issues shares

under the 2006 Plan in connection with director compensation. These shares are currently issued out of treasury

stock and are not material.

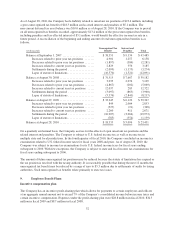

The Company’s results for fiscal 2010, fiscal 2009 and fiscal 2008 include stock-based compensation expense of

$15.7 million, $13.3 million and $11.3 million, respectively. These amounts are included within SG&A on the

Consolidated Statements of Income. Tax benefits recognized in fiscal 2010, fiscal 2009 and fiscal 2008 for stock-

based compensation totaled $5.8 million, $4.9 million and $4.2 million, respectively.

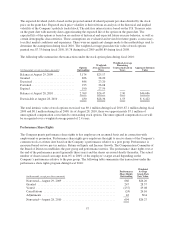

Stock Options

The Company grants stock options to key employees at prices not less than the fair market value of the

Company’s common stock on the grant date. The Company’s practice for a number of years has been to make a

single annual grant to all employees participating in the stock option program and generally to make other grants

only in connection with employment or promotions. Options expire five years from the grant date and are

exercisable to the extent of 40% after the second anniversary of the grant and an additional 30% at each of the

following two anniversary dates on a cumulative basis. Compensation cost is recognized on a straight-line basis,

net of estimated forfeitures, over the requisite service period. The Company uses the Black-Scholes option-

pricing model to estimate the grant-date fair value of each option. The fair values of options granted were

estimated using the following weighted-average assumptions:

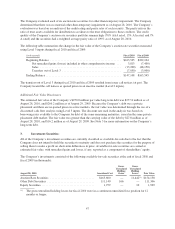

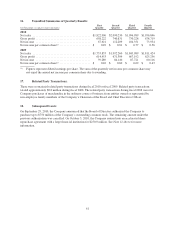

Years Ended

August 28, 2010 August 29, 2009 August 30, 2008

Expected dividend yield ...................... 2.27% 2.51% 2.08%

Expected stock price volatility ................. 35.20% 34.00% 29.00%

Weighted average risk-free interest rate ......... 2.07% 2.23% 4.28%

Expected life of options (years) ................ 4.50 4.43 4.45

56