Dollar General 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

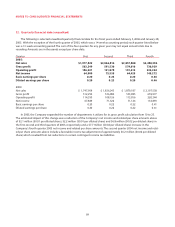

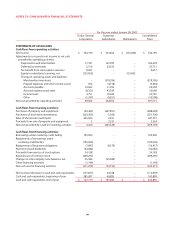

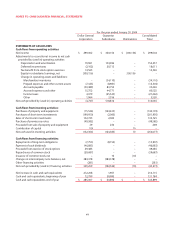

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

For the year ended January 28, 2005

Dollar General Guarantor Consolidated

Corporation Subsidiaries Eliminations Total

STATEMENTS OF CASH FLOWS:

Cash flows from operating activities:

Net income $ 344,190 $ 333,852 $ (333,852) $ 344,190

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 17,181 147,297 – 164,478

Deferred income taxes 5,516 20,235 – 25,751

Tax benefit from stock option exercises 9,657 – – 9,657

Equity in subsidiaries’ earnings, net (333,852) – 333,852 –

Change in operating assets and liabilities:

Merchandise inventories – (219,396) – (219,396)

Prepaid expenses and other current assets 652 (4,318) – (3,666)

Accounts payable 10,665 11,593 – 22,258

Accrued expenses and other (8,351) 43,399 – 35,048

Income taxes 4,751 19,042 – 23,793

Other (1,347) (9,251) – (10,598)

Net cash provided by operating activities 49,062 342,453 – 391,515

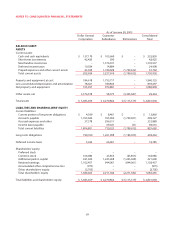

Cash flows from investing activities:

Purchases of property and equipment (20,443) (267,851) – (288,294)

Purchases of short-term investments (220,200) (1,500) – (221,700)

Sales of short-term investments 245,000 2,501 – 247,501

Proceeds from sale of property and equipment 3 3,321 – 3,324

Net cash provided by (used in) investing activities 4,360 (263,529) – (259,169)

Cash flows from financing activities:

Borrowings under revolving credit facility 195,000 – – 195,000

Repayments of borrowings under

revolving credit facility (195,000) – – (195,000)

Repayments of long-term obligations (7,847) (8,570) – (16,417)

Payment of cash dividends (52,682) – – (52,682)

Proceeds from exercise of stock options 34,128 – – 34,128

Repurchases of common stock (209,295) – – (209,295)

Changes in intercompany note balances, net 25,586 (25,586) – –

Other financing activities (1,149) – – (1,149)

Net cash used in financing activities (211,259) (34,156) – (245,415)

Net increase (decrease) in cash and cash equivalents (157,837) 44,768 – (113,069)

Cash and cash equivalents, beginning of year 285,007 60,892 – 345,899

Cash and cash equivalents, end of year $ 127,170 $ 105,660 $ – $ 232,830