Dollar General 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

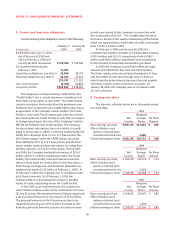

(In thousands) 2005 2004

Deferred tax assets:

Deferred compensation expense $15,166 $17,310

Accrued expenses and other 3,916 4,006

Accrued rent 7,137 4,883

Accrued insurance 9,240 25,950

Deferred gain on sale/leasebacks 2,465 2,624

Other 3,712 3,755

State tax net operating loss

carryforwards, net of federal tax 7,416 9,180

State tax credit carryforwards,

net of federal tax 4,711 1,982

53,763 69,690

Less valuation allowances (2,038) (2,126)

Total deferred tax assets 51,725 67,564

Deferred tax liabilities:

Property and equipment (74,609) (82,807)

Inventories (32,301) (31,635)

Other (536) (599)

Total deferred tax liabilities (107,446) (115,041)

Net deferred tax liabilities $(55,721) $(47,477)

Net deferred tax liabilities are reflected separately on

the consolidated balance sheets as current and noncur-

rent deferred income taxes.The following table summa-

rizes net deferred income tax liabilities from the consoli-

dated balance sheets:

(In thousands) 2005 2004

Current deferred income tax

assets, net $ 11,912 $ 24,908

Noncurrent deferred income tax

liabilities, net (67,633) (72,385)

Net deferred tax liabilities $ (55,721) $ (47,477)

State net operating loss carryforwards as of February

3, 2006, totaled approximately $186 million and will expire

beginning in 2006 through 2023. The Company also has

state credit carryforwards of approximately $7.3 million

that will expire beginning in 2006 through 2016.

The valuation allowance, as of 2005, has been provid-

ed principally for certain state tax credit carryforwards. In

2005, after an internal restructuring, all valuation

allowances related to state net operating loss carryforwards

were removed resulting in a reduction in the valuation

allowance of approximately $1.1 million. This decrease

was offset by additions to the valuation allowance applied

to certain state tax credit carryforwards of approximately

$0.9 million due to the same internal restructuring. The

remaining change in the valuation allowance, an increase

of approximately $0.1 million, related primarily to changes

in state tax credits that were unrelated to the 2005 inter-

nal restructuring.

Approximately $1.0 million of the 2003 valuation

allowance reduction was due to certain state tax law

changes during the year which caused the future recogni-

tion of certain state tax credit carryforwards to be consid-

ered more likely than not to occur, thereby resulting in the

reduction of a valuation allowance created in an earlier

year. The change in the valuation allowance, including the

changes noted above, was a decrease of $0.1 million, $0.1

million and $0.6 million in 2005, 2004, and 2003, respec-

tively. Based upon expected future income and available

tax planning strategies, management believes that it is

more likely than not that the results of operations will

generate sufficient taxable income to realize the deferred

tax assets after giving consideration to the valuation

allowance.

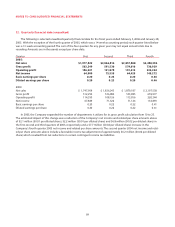

The Company estimates its contingent income tax

liabilities based on its assessment of probable income

tax-related exposures and the anticipated settlement of

those exposures translating into actual future liabilities. As

of February 3, 2006 and January 28, 2005, the Company’s

accrual for these contingent liabilities, included in Income

taxes payable in the consolidated balance sheets, was

approximately $13.4 million and $13.5 million, respectively,

and the related accrued interest included in Accrued

expenses and other in the consolidated balance sheets was

approximately $6.2 million and $6.9 million respectively.

As of February 3, 2006 and January 28, 2005, the

Company had additional exposure in the amount of $3.8

million and $3.0 million, respectively, related to contingent

income tax liabilities that had a reasonable possibility of

being recognized as a loss in a future period. These addi-

tional amounts relate principally to income tax audits. As

the Company does not consider it probable that a loss has

yet been incurred related to these items, no portion of

these liabilities has been recorded.