Dollar General 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

of shares of restricted stock or restricted stock units

eligible for issuance under the terms of this plan has been

capped at 4,000,000. At February 3, 2006, 3,510,841 shares

of restricted stock or restricted stock units were available

for grant under the plan.

During 2003, the Company also granted stock options

and restricted stock in transactions that were not made

under the stock incentive plan.The Company awarded

78,865 shares of restricted stock as a material inducement

to employment to its CEO at a fair value of $12.68 per

share. The difference between the market price of the

underlying stock and the purchase price on the date of

grant, which was set as zero for this restricted stock award,

was recorded as unearned compensation expense, and is

being amortized to expense on a straight-line basis over

the restriction period of five years. The CEO is entitled to

receive cash dividends and to vote these shares, but is pro-

hibited from selling or transferring shares prior to vesting.

Also during the first quarter of 2003, the Company award-

ed the CEO, as a material inducement to employment, an

option to purchase 500,000 shares at an exercise price of

$12.68 per share.The option generally vests at a rate of

166,666 shares on the second anniversary of the grant

date and 333,334 shares on the third anniversary of the

grant date, subject to accelerated vesting as provided in

the CEO’s Employment Agreement or in the plan. The

option will terminate no later than 10 years from the

grant date.

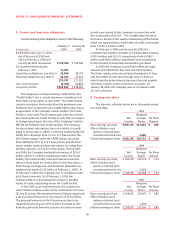

Pro forma information regarding net income and

earnings per share, as disclosed in Note 1, has been deter-

mined as if the Company had accounted for its employee

stock-based compensation plans under the fair value

method of SFAS No. 123. The fair value of options granted

during 2005, 2004 and 2003 was $6.33, $6.36 and $5.45,

respectively.The fair value of each stock option grant was

estimated on the date of grant using the Black-Scholes

option pricing model with the following assumptions:

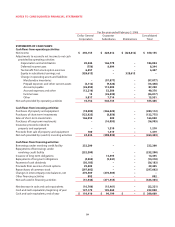

2005 2004 2003

Expected dividend yield 0.9% 0.9% 0.9%

Expected stock price volatility 27.1% 35.5% 36.9%

Weighted average

risk-free interest rate 4.2% 3.5% 2.7%

Expected life of options (years) 5.0 5.0 3.7

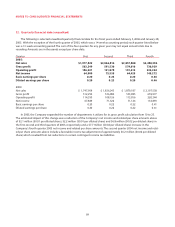

A summary of the balances and activity for all of the

Company’s stock option awards for the last three fiscal

years is presented below:

Weighted

Average

Options Exercise

Issued Price

Balance, January 31, 2003 26,916,571 $ 15.73

Granted 4,705,586 18.39

Exercised (4,240,438) 11.68

Canceled (2,450,429) 17.76

Balance, January 30, 2004 24,931,290 16.75

Granted 2,250,900 18.88

Exercised (2,874,828) 11.87

Canceled (1,758,030) 18.97

Balance, January 28, 2005 22,549,332 17.42

Granted 2,364,200 21.72

Exercised (2,248,951) 13.07

Canceled (2,406,257) 19.23

Balance, February 3, 2006 20,258,324 $ 18.19

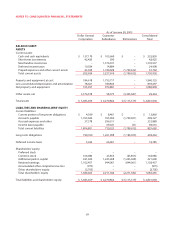

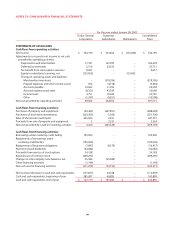

The following table summarizes information about all stock options outstanding at February 3, 2006:

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Range of Number Remaining Average Number Average

Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$ 6.29 - $12.68 1,914,579 4.4 $ 11.11 1,581,245 $ 10.78

12.88 - 18.55 7,001,557 5.0 15.90 6,800,557 15.86

18.74 - 23.90 11,342,188 6.1 20.80 10,998,588 20.79

$ 6.29 - $23.90 20,258,324 5.6 $ 18.19 19,380,390 $ 18.24