Dollar General 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

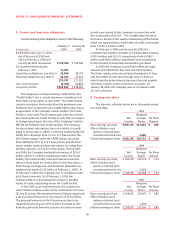

The balance remaining in Accumulated other compre-

hensive loss at February 3, 2006 relates solely to deferred

losses realized in June 2000 on the settlement of an interest

rate derivative that was designated and effective as a cash

flow hedge of the Company’s forecasted issuance of its

$200 million of fixed rate notes in June 2000 (see Note 5).

This amount will be reclassified into earnings as an adjust-

ment to the effective interest expense on the fixed rate

notes through their maturity date in June 2010.The

Company estimates that it will reclassify into earnings

during the next twelve months approximately $0.2 million

of the net amount recorded in Other comprehensive loss

as of February 3, 2006.

Stock-based compensation

The Company has a shareholder-approved stock

incentive plan under which stock options, restricted stock,

restricted stock units and other equity-based awards may

be granted to officers, directors and key employees. Prior

to June 2003, the plan provided for automatic annual

stock option grants to non-employee directors pursuant

to a non-discretionary formula. Those stock options

vested one year after the grant date and generally have

a ten-year life.

Stock options currently are granted under this plan at

the market price on the grant date and have a ten-year life

subject to earlier termination upon death, disability or ces-

sation of employment. Stock options granted under this

plan (other than those granted to directors pursuant to

the automatic grant provisions discussed above) generally

vest ratably over a four-year period, with certain excep-

tions as further described in Note 9. However, on January

24, 2006, the Compensation Committee of the Company’s

Board of Directors accelerated the vesting of most

of the Company’s outstanding stock options as further

described in Note 9.

The Company accounts for stock option grants in

accordance with Accounting Principles Board Opinion No.

25,“Accounting for Stock Issued to Employees”(“APB No.

25”), and related interpretations. Under APB No. 25, com-

pensation expense is generally not recognized for plans in

which the exercise price of the stock options equals the

market price of the underlying stock on the date of grant

and the number of shares subject to exercise is fixed. Had

compensation cost for the Company’s stock-based com-

pensation plans been determined based on the fair value

at the grant date for awards under these plans consistent

with the methodology prescribed under SFAS No. 123

(with compensation expense amortized ratably over the

applicable vesting periods), net income and earnings per

share would have been reduced to the pro forma amounts

indicated in the following table.

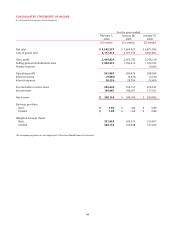

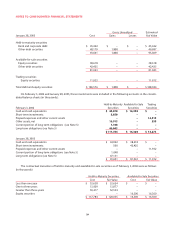

(Amounts in thousands

except per share data) 2005 2004 2003

Net income – as reported $350,155 $344,190 $299,002

Less pro forma effect of

stock-based compensation

cost, net of taxes 32,621 10,724 7,867

Net income – pro forma $317,534 $333,466 $291,135

Earnings per share –

as reported

Basic $ 1.09 $ 1.04 $ 0.89

Diluted $ 1.08 $ 1.04 $ 0.89

Earnings per share –

pro forma

Basic $ 0.99 $ 1.01 $ 0.87

Diluted $ 0.98 $ 1.00 $ 0.86

The increase in the pro-forma stock-based compensa-

tion cost in 2005 was the result of the acceleration of the

vesting of certain stock options as further discussed in

Note 9.The decision to accelerate the vesting of stock

options was made primarily to reduce non-cash compen-

sation expense that would have been recorded in future

periods following the adoption of SFAS No. 123(R) in the

first quarter of fiscal year 2006.

As allowed by the stock incentive plans, the Company

has historically extended the exercise period for outstand-

ing stock option grants to three years from the date of

cessation of employment with the Company for former

employees who meet certain “early retirement” criteria

which may include their age and years of service, to the

extent that their stock options were fully vested at the

date their employment ended. However, this practice does

not extend the ten-year maximum contractual exercise

term following the date of grant. Upon the adoption of

SFAS No. 123(R),“Share-Based Payment” discussed below,

the Company will be required to record compensation

costs over the period through the date that such

employees are no longer required to provide service

to earn the award (generally, the first date that the

employee is eligible to retire).

The Company may periodically award restricted stock

or restricted stock units to officers and other key employ-

ees under the stock incentive plan. The terms of the stock

incentive plan limit the total number of shares of restrict-

ed stock and restricted stock units eligible for issuance

thereunder to a maximum of 4 million shares. Restricted

stock awards consist of a fixed number of shares of

common stock that generally vest ratably over three years.

Restricted stock units represent the right to receive one

share of common stock for each unit upon vesting and

generally vest ratably over three years. In addition, the

stock incentive plan was amended in June 2003 to provide