Dollar General 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

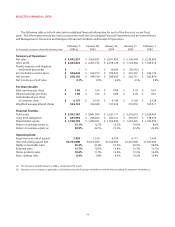

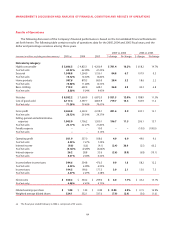

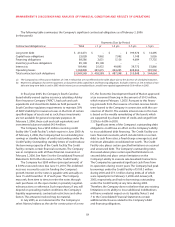

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

all distribution capacity and to decrease stem miles

between the DCs and the stores;

• We increased annual inventory turns to 4.2 times in

2005, including the 53rd week, from 4.0 times in 2004

and reduced inventory levels on a per-store basis by

1% as of year end. The Company has executed end-of-

season markdowns over the past two years to

minimize seasonal inventory carried forward to the

following year. The Company made substantial

progress on this initiative in 2005 and continues to

aggressively identify, evaluate, merchandise and

markdown aged inventory;

• We introduced Dollar General gift cards before the

Christmas holiday season;

• We introduced Fisher-Price® branded children’s

apparel and Bobbie Brooks® apparel for women in

our stores;

• We developed and installed new systems to provide

enhanced store operating statements, supplier

communications and transportation and claims

management; and

• We generated sufficient cash flow to allow the

Company to repurchase approximately 15 million

shares of its common stock for $297.6 million and

to increase our per share dividend to shareholders

by over 9%.

The Company believes its 2005 sales (particularly in

more discretionary, higher gross profit categories) were

negatively impacted by the effect on its typical low- to

middle-income customer of high gasoline and heating

fuel prices as well as higher interest rates and increasing

consumer debt levels. The Company’s gross profit rate was

negatively impacted for the year by several factors as

further discussed in “Results of Operations” below, but was

most notably affected by the decrease, as a percentage

of sales, in sales of higher gross profit merchandise

categories and higher transportation fuel costs.

In 2005, Hurricanes Katrina and Rita made landfall in

the Gulf Coast, impacting our operations, our customers,

and our employees. At the peak, approximately 350 stores

were temporarily closed due to Hurricane Katrina and 330

stores were temporarily closed due to Hurricane Rita. The

Company ultimately closed 41 stores as a result of the

hurricanes, and suffered the total destruction of inventory

in 29 of those stores due to Hurricane Katrina and 3 of

those stores due to Hurricane Rita. Significant losses of

inventory and fixed assets, in the form of store fixtures and

leasehold improvements, were caused by the hurricanes.

These losses were offset by insurance proceeds received

during the year. In addition, the Company expects to

record additional insurance proceeds in excess of the cost

of the asset losses in the future. Significant business inter-

ruption was experienced during the hurricanes.The

Company did not recover any business interruption insur-

ance proceeds during the year, and will not record any

such proceeds until the business interruption claims are

substantially settled.

Company Performance Measures. Management uses

a number of metrics, including those indicated on the

table included in “Results of Operations” below, to assess

its performance. The following are the more frequently

discussed metrics:

• Earnings per share (“EPS”) growth is an indicator of

the increased returns generated for the Company’s

shareholders. EPS of $1.08 in 2005 reflected an

increase of 3.8 percent over EPS of $1.04 reported in

2004.

• Total net sales growth indicates, among other things,

the success of the Company’s selection of new store

locations and merchandising strategies. Total net sales

increased 12.0% in 2005, including the impact of the

53rd week.

• Same-store sales growth indicates whether our mer-

chandising strategies,store execution and customer

service in existing stores have been successful in

generating increased sales. Same-store sales increased

2.0 percent in 2005, with stronger same-store sales in

the first half of the year than the latter half. Sales were

negatively impacted for the year by the economic

factors discussed above. However, the latter half of the

year was increasingly impacted by promotional efforts

of competitors. Same-store sales in 2004 increased by

3.2 percent.

• Operating margin rate (operating profit divided by net

sales), which is an indicator of the Company’s success

in leveraging its fixed costs and managing its variable

costs, declined to 6.5 percent in 2005 versus 7.3

percent in 2004.The various components impacting

this metric are fully discussed in “Results of

Operations” below.

• Free cash flow (the sum of net cash flows from operat-

ing activities, net cash flows from investing activities

and net cash flows from financing activities, excluding

share repurchases and changes in debt other than

required payments). Although this measure is a non-

GAAP measure, the Company believes it is useful as an

indicator of the cash flow generating capacity of the

Company’s operations. It is also a useful metric to ana-

lyze in conjunction with net income to determine

whether there is any significant non-cash component

to the Company’s net income.The Company generat-