Dollar General 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

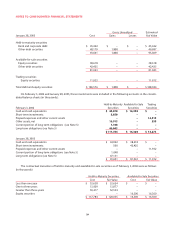

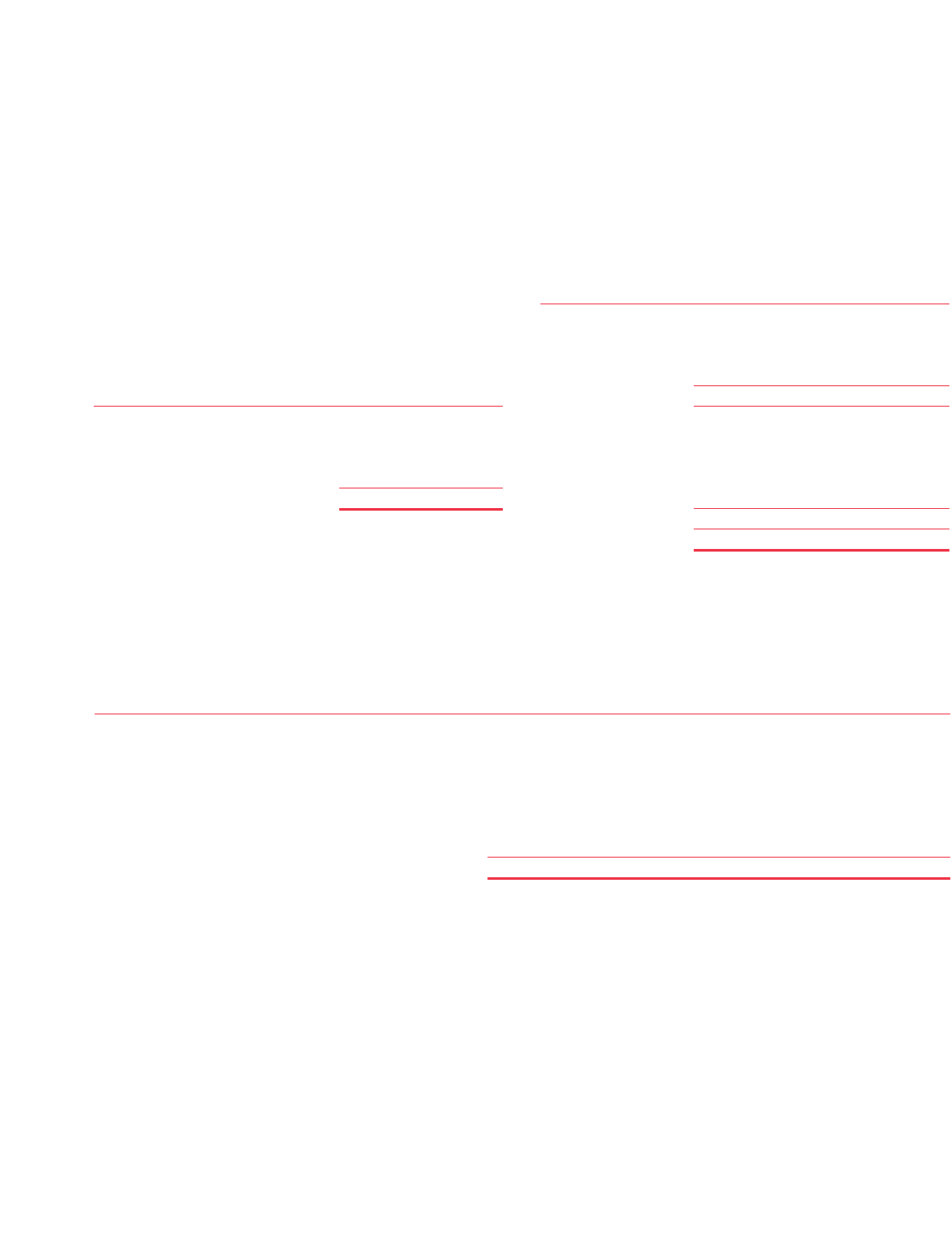

A reconciliation between actual income taxes and amounts computed by applying the federal statutory rate to

income before income taxes is summarized as follows:

(Dollars in thousands) 2005 2004 2003

U.S. federal statutory rate on earnings before

income taxes $190,625 35.0% $187,165 35.0% $166,783 35.0%

State income taxes, net of federal income tax benefit 6,223 1.1 8,168 1.5 10,773 2.3

Jobs credits, net of federal income taxes (4,503) (0.8) (5,544) (1.0) (3,817) (0.8)

Decrease in valuation allowances (88) (0.0) (106) (0.0) (582) (0.1)

Non-deductible penalty –– – – 3,500 0.7

Other 2,230 0.4 884 0.1 864 0.2

$194,487 35.7% $ 190,567 35.6% $177,521 37.3%

While the 2005 and 2004 rates were similar overall, the rates contained offsetting differences. Non-recurring factors

causing the 2005 tax rate to increase when compared to the 2004 tax rate include a reduction in federal jobs credits of

approximately $1.0 million, additional net foreign income tax expense of approximately $0.8 million and a decrease in the

contingent income tax reserve due to resolution of contingent liabilities that is $3.6 million less than the decrease that

occurred in 2004. Non-recurring factors causing the 2005 tax rate to decrease when compared to the 2004 tax rate include

the recognition of state tax credits of approximately $2.3 million related to the Company’s construction of a distribution

center in Indiana and a non-recurring benefit of approximately $2.6 million related to an internal restructuring that was

completed during 2005.

The 2004 rate was lower than the 2003 rate primarily due to the reversal of certain contingent income tax liabilities of

approximately $6.2 million in 2004, when the Company adjusted its tax contingency reserve based upon the results of two

state income tax examinations. The tax rate in 2003 was negatively impacted by the $10.0 million penalty expense in 2003,

related to the restatement of the Company’s 2001 and earlier financial statements, which was not deductible for income

tax purposes.

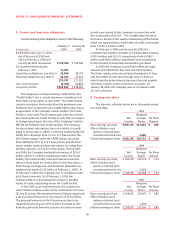

Deferred taxes reflect the effects of temporary differences between carrying amounts of assets and liabilities for finan-

cial reporting purposes and the amounts used for income tax purposes. Significant components of the Company’s

deferred tax assets and liabilities are as follows:

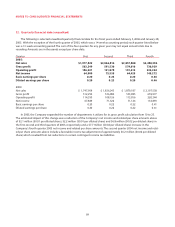

Depreciation expense related to property and

equipment was approximately $186.1 million, $163.1

million and $150.9 million in 2005, 2004 and 2003, respec-

tively. Amortization of capital lease assets is included in

depreciation expense.

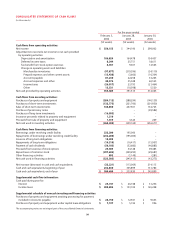

3. Accrued expenses and other

Accrued expenses and other consist of the following:

(In thousands) 2005 2004

Compensation and benefits $ 53,784 $ 60,635

Insurance 154,693 130,506

Taxes (other than taxes on income) 58,967 45,005

Other 105,476 97,743

$ 372,920 $ 333,889

Other accrued expenses primarily include liabilities

for deferred rent, freight expense, contingent rent expense,

interest, electricity, and common area maintenance charges.

4. Income taxes

The provision (benefit) for income taxes consists of

the following:

(In thousands) 2005 2004 2003

Current:

Federal $ 175,344 $ 155,497 $ 145,072

Foreign 1,205 1,169 –

State 9,694 8,150 13,838

186,243 164,816 158,910

Deferred:

Federal 8,479 21,515 17,224

Foreign 17 21 –

State (252) 4,215 1,387

8,244 25,751 18,611

$194,487 $190,567 $177,521