Dollar General 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

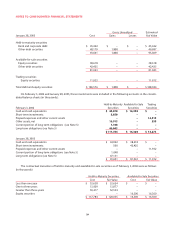

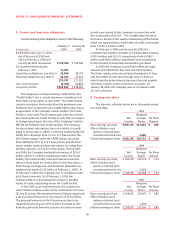

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

for the automatic annual grant of 4,600 restricted stock

units to each non-employee director (6,000 restricted

stock units to any non-employee director serving as

Chairman) in lieu of the automatic annual stock option

grants to directors discussed previously. The initial

grant of these restricted stock units was made in 2004.

These units generally vest one year after the grant date,

subject to earlier vesting upon retirement or other

circumstances described in the plan, but no payout shall

be made until the individual has ceased to be a member

of the Board of Directors. Dividends or dividend equiva-

lents, as the case may be, are paid or accrued on the grants

to officers and directors of restricted stock and restricted

stock units at the same rate that dividends are paid to

shareholders generally.

The Company accounts for restricted stock grants in

accordance with APB No. 25 and related interpretations.

Under APB No. 25, the Company calculates compensation

expense as the difference between the market price of the

underlying stock on the date of grant and the purchase

price, if any, and recognizes such amount on a straight-line

basis over the period in which the restricted stock award is

earned by the recipient. The Company recognized com-

pensation expense relating to its restricted stock awards

of approximately $2.4 million, $1.8 million and $0.4 million

in 2005, 2004 and 2003, respectively (see Note 9).

Revenue and gain recognition

The Company recognizes retail sales in its stores at

the time the customer takes possession of merchandise.

All sales are net of discounts and returns and exclude sales

tax. The reserve for retail merchandise returns is based on

the Company’s prior experience.The Company records

gain contingencies when realized.

The Company began gift card sales in the third

quarter of 2005. The Company recognizes gift card sales

revenue at the time of redemption. The liability for the

gift cards is established for the cash value at the time of

purchase.The liability for outstanding gift cards is record-

ed in Accrued expenses and other.

Advertising costs

Advertising costs are expensed as incurred and were

$15.1 million, $7.9 million and $5.4 million in 2005, 2004

and 2003, respectively. These costs primarily related to tar-

geted circulars supporting new stores and in-store sig-

nage. Additionally, beginning in 2005, the Company

expanded its marketing and advertising efforts with the

sponsorship of a National Association for Stock Car Auto

Racing (“NASCAR”) team.

Capitalized interest

To assure that interest costs properly reflect only that

portion relating to current operations, interest on bor-

rowed funds during the construction of property and

equipment is capitalized. Interest costs capitalized were

approximately $3.3 million, $3.6 million and $0.2 million in

2005, 2004 and 2003, respectively.

Income taxes

The Company reports income taxes in accordance

with SFAS No. 109,“Accounting for Income Taxes.” Under

SFAS No. 109, the asset and liability method is used for

computing future income tax consequences of events that

have been recognized in the Company’s consolidated

financial statements or income tax returns. Deferred

income tax expense or benefit is the net change during

the year in the Company’s deferred income tax assets

and liabilities.

Management estimates

The preparation of financial statements and related

disclosures in conformity with accounting principles gen-

erally accepted in the United States requires management

to make estimates and assumptions that affect the report-

ed amounts of assets and liabilities and disclosure of con-

tingent assets and liabilities at the date of the consolidat-

ed financial statements and the reported amounts of

revenues and expenses during the reporting periods.

Actual results could differ from those estimates.

Accounting pronouncements

In December 2004, the Financial Accounting

Standards Board (“FASB”) issued Statement of Financial

Accounting Standards (“SFAS”) No. 123(R),“Share-Based

Payment,” which will require an entity to measure com-

pensation cost for all share-based payments (including

grants of employee stock options) at fair value. The

Company will adopt SFAS No. 123(R) during the first quar-

ter of 2006 and expects to apply the standard using the

modified prospective method, which requires compensa-

tion expense to be recorded for new and modified awards

and also for unvested portions of previously issued and

outstanding awards. The Company expects to incur incre-

mental SG&A expense associated with the adoption of

approximately $5 million in 2006, dependent upon the

number of grants and their related fair market values. See

Stock-based compensation above for disclosure of the pro

forma effects of stock option grants as determined using

the methodology prescribed under SFAS No. 123.

SFAS No. 123(R) also requires the benefits of tax

deductions in excess of recognized compensation cost be

reported as a financing cash flow, rather than as an