Dollar General 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

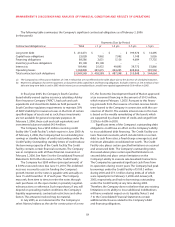

In fiscal year 2005, the Company’s South Carolina-

based wholly owned captive insurance subsidiary, Ashley

River Insurance Company (“ARIC”), had cash and cash

equivalents and investments balances held pursuant to

South Carolina regulatory requirements to maintain 30%

of ARIC’s liability for insurance losses in the form of certain

specified types of assets and as such, these investments

are not available for general corporate purposes. At

February 3, 2006, these cash and cash equivalents and

investments balances totaled $43.4 million.

The Company has a $250 million revolving credit

facility (the “Credit Facility”), which expires in June 2009. As

of February 3, 2006, the Company had no outstanding bor-

rowings or standby letters of credit outstanding under the

Credit Facility. Outstanding standby letters of credit reduce

the borrowing capacity of the Credit Facility.The Credit

Facility contains certain financial covenants.The Company

was in compliance with all these financial covenants at

February 3, 2006. See Note 5 to the Consolidated Financial

Statements for further discussion of the Credit Facility.

The Company has $200 million (principal amount) of

8 5/8% unsecured notes due June 15, 2010. This indebted-

ness was incurred to assist in funding the Company’s

growth. Interest on the notes is payable semi-annually on

June 15 and December 15 of each year. The Company

may seek, from time to time, to retire the notes through

cash purchases on the open market, in privately negotiat-

ed transactions or otherwise. Such repurchases, if any, will

depend on prevailing market conditions, the Company’s

liquidity requirements, contractual restrictions and other

factors.The amounts involved may be material.

In July 2005, as an inducement for the Company to

select Marion, Indiana as the site for construction of a new

DC, the Economic Development Board of Marion approved

a tax increment financing in the amount of $14.5 million,

which matures February 1, 2035. Pursuant to this financ-

ing, proceeds from the issuance of certain revenue bonds

were loaned to the Company in connection with the con-

struction of this DC. The variable interest rate on this loan

is based on the weekly remarketing of the bonds, which

are supported by a bank letter of credit, and ranged from

3.52% to 4.60% in 2005.

Significant terms of the Company’s outstanding debt

obligations could have an effect on the Company’s ability

to incur additional debt financing. The Credit Facility con-

tains financial covenants, which include limits on certain

debt to cash flow ratios, a fixed charge coverage test, and

minimum allowable consolidated net worth. The Credit

Facility also places certain specified limitations on secured

and unsecured debt. The Company’s outstanding notes

discussed above place certain specified limitations on

secured debt and place certain limitations on the

Company’s ability to execute sale-leaseback transactions.

The Company has generated significant cash flows from

its operations during recent years. The Company had peak

borrowings under the Credit Facility of $100.3 million

during 2005 and $73.1 million during 2004, all of which

were repaid prior to February 3, 2006 and January 28,

2005, respectively, and had no borrowings outstanding

under the Credit Facility at any time during 2003.

Therefore, the Company does not believe that any existing

limitations on its ability to incur additional indebtedness

will have a material impact on its liquidity. Notes 5 and

7 to the Consolidated Financial Statements contain

additional disclosures related to the Company’s debt

and financing obligations.

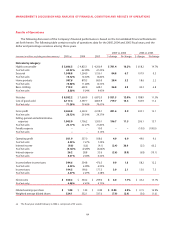

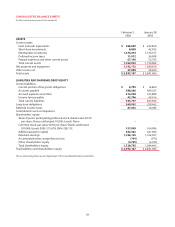

The following table summarizes the Company’s significant contractual obligations as of February 3, 2006

(in thousands):

Payments Due by Period

Contractual obligations(a) Total < 1 yr 1-3 yrs 3-5 yrs > 5 yrs

Long-term debt $ 214,473 $ – $ – $ 199,978 $ 14,495

Capital lease obligations 22,028 7,862 7,992 1,148 5,026

Financing obligations 89,586 2,031 5,136 4,684 77,735

Inventory purchase obligations 85,148 85,148 – – –

Interest (b) 169,466 25,933 49,895 39,772 53,866

Operating leases 1,368,848 281,615 424,225 269,466 393,542

Total contractual cash obligations $1,949,549 $ 402,589 $ 487,248 $ 515,048 $ 544,664

(a) The Company has self-insurance liabilities of $154.7 million that are not reflected in the table above due to the absence of scheduled maturities.

(b) Represents obligations for interest payments on long-term debt, capital lease and financing obligations. Excludes interest on $14.5 million of vari-

able rate long-term debt issued in 2005 which interest, on an annualized basis, would have equaled approximately $0.6 million in 2005.