Dollar General 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ficient information to reasonably estimate the fair value of

an asset retirement obligation. The Company adopted the

provisions of FIN 47 during the fourth quarter of 2005, and

this adoption did not have a material impact on the

Company’s Consolidated Financial Statements as a whole.

Non-GAAP disclosures

The Company has included in this document free

cash flow generated in 2005 and 2004. Free cash flow is a

measure not derived in accordance with generally accept-

ed accounting principles (“GAAP”). The Company believes

that this information is useful to investors as an indicator

of the cash flow generating capacity of the Company’s

operations. It is also a useful metric to analyze in conjunc-

tion with net income to determine whether there is any

significant non-cash component to the Company’s net

income.This information should not be considered a sub-

stitute for any measures derived in accordance with GAAP.

Management may use this information to better under-

stand the Company’s underlying operating results.

A reconciliation of the Company’s calculation of free cash

flow to the most comparable measure derived in accor-

dance with GAAP is set forth below.

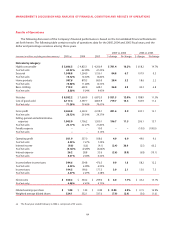

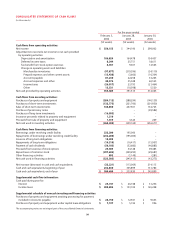

For the years ended

February 3, January 28, January 30,

(In thousands) 2006 2005 2004

(53 weeks) (52 weeks) (52 weeks)

Net increase (decrease)

in cash and cash

equivalents

(a)

$ (32,221) $(113,069) $ 214,115

Less issuance of

long-term borrowings (14,495) ––

Plus repurchases of

common stock 297,602 209,295 29,687

Free cash flow $ 250,886 $ 96,226 $ 243,802

(a) Equal to the sum of net cash flows from operating activities, net

cash flows from investing activities and net cash flows from

financing activities.

Financial Risk Management

The Company is exposed to market risk primarily from

adverse changes in interest rates. To minimize such risk,

the Company may periodically use financial instruments,

including derivatives. As a matter of policy, the Company

does not buy or sell financial instruments for speculative

or trading purposes and all financial instrument transactions

must be authorized and executed pursuant to approval by

the Board of Directors. All financial instrument positions

taken by the Company are used to reduce risk by hedging

an underlying economic exposure. Because of high corre-

lation between the financial instrument and the underly-

ing exposure being hedged, fluctuations in the value of

the financial instruments are generally offset by reciprocal

changes in the value of the underlying economic expo-

sure. The financial instruments used by the Company are

straightforward instruments with liquid markets.

The Company has cash flow exposure relating to vari-

able interest rates associated with its revolving line of

credit and tax increment financing,and may periodically

seek to manage this risk through the use of interest rate

derivatives. The primary interest rate exposure on vari-

able rate obligations is based on the London Interbank

Offered Rate (“LIBOR”). The Company was not party to

any interest rate derivatives in 2005 or 2004.

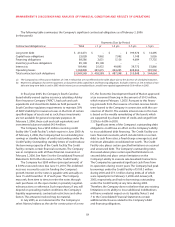

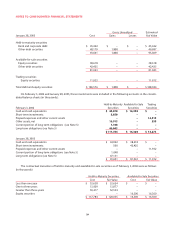

At February 3, 2006 and January 28, 2005, the fair

value of the Company’s debt, excluding capital lease

obligations, was approximately $281.0 million and $275.9

million, respectively (net of the fair value of a note receiv-

able on the South Boston, Virginia DC of approximately

$49.5 million and $50.0 million, respectively, as further

discussed in Note 7 to the Consolidated Financial Statements),

based upon the estimated market value of the debt at

those dates. Such fair value exceeded the carrying values

of the debt at February 3, 2006 and January 28, 2005 by

approximately $24.2 million and $32.7 million, respectively.

Based upon the Company’s variable rate borrowing

levels, a 1% adverse change in interest rates would have

resulted in a pre-tax reduction of earnings and cash flows

on an annualized basis of approximately $0.1 million in

2005 and less than $0.1 million in 2004. In 2003, the

Company had no outstanding variable rate borrowings.

Based upon the Company’s outstanding indebtedness at

February 3, 2006 and January 28, 2005, a 1% reduction in

interest rates would have resulted in an increase in the fair

value of the Company’s fixed rate debt of approximately

$12.2 million and $14.2 million, respectively.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK