Dollar General 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

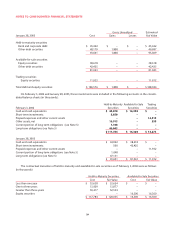

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

and $18.0 million at February 3, 2006 and January 28,

2005, respectively.

The Company recognizes contingent rental expense

when the achievement of specified sales targets are con-

sidered probable, in accordance with EITF Issue No. 98-9,

“Accounting for Contingent Rent.”The amount expensed

but not paid as of February 3, 2006 and January 28, 2005

was approximately $9.3 million and $8.6 million, respec-

tively, and is included in Accrued expenses and other in

the consolidated balance sheets. (See Notes 3 and 7).

Insurance reserves

The Company retains a significant portion of risk

for its workers' compensation, employee health, general

liability, property and automobile claim exposures.

Accordingly, provisions are made for the Company's

estimates of such risks. Actuaries are utilized to determine

the undiscounted future claim costs for the workers'

compensation, general liability, and health claim risks.

To the extent that subsequent claim costs vary from those

estimates, future results of operations will be affected.

Ashley River Insurance Company (or ARIC, as defined

above), a South Carolina-based wholly owned captive

insurance subsidiary of the Company, charges the

operating subsidiary companies premiums to insure the

retained workers' compensation and non-property

general liability exposures. Pursuant to South Carolina

insurance regulations, ARIC has cash and cash equivalents

and investment balances that are subject to restrictions

and are not available for general corporate purposes, as

further described above under “Investments in debt and

equity securities.” ARIC currently insures no unrelated

third-party risk.The Greater Cumberland Insurance

Company, formerly a Vermont-based wholly owned

captive insurance subsidiary of the Company, was

liquidated in 2005.

Fair value of financial instruments

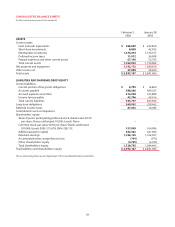

The carrying amounts reflected in the consolidated

balance sheets for cash, cash equivalents, short-term

investments, receivables and payables approximate their

respective fair values. At February 3, 2006 and January 28,

2005, the fair value of the Company’s debt, excluding

capital lease obligations, was approximately $281.0 million

and $275.9 million, respectively (net of the fair value of a

note receivable on the South Boston, Virginia DC of

approximately $49.5 million and $50.0 million, respective-

ly, as further discussed in Note 7), based upon the

estimated market value of the debt at those dates. Such

fair value exceeded the carrying values of the debt at

February 3, 2006 and January 28, 2005 by approximately

$24.2 million and $32.7 million, respectively. Fair values

are based primarily on quoted prices for those or similar

instruments. A discussion of the carrying value and

fair value of the Company’s derivative financial instru-

ments is included in the section entitled “Derivative

financial instruments”below.

Derivative financial instruments

The Company accounts for derivative financial instru-

ments in accordance with the provisions of SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities”, as amended by SFAS Nos. 137, 138 and 149 and

interpreted by numerous Financial Accounting Standards

Board (“FASB”) Issues. These statements require the

Company to recognize all derivative instruments on the

balance sheet at fair value, and contain accounting rules

for hedging instruments,which depend on the nature of

the hedge relationship.

The Company has historically used derivative financial

instruments primarily to reduce its exposure to adverse

fluctuations in interest rates and, to a much lesser extent,

other market exposures.

As a matter of policy, the Company does not buy or

sell financial instruments, including derivatives, for specu-

lative or trading purposes and all financial instrument

transactions must be authorized and executed pursuant to

the approval of the Board of Directors. All financial instru-

ment positions taken by the Company are used to reduce

risk by hedging an underlying economic exposure and are

structured as straightforward instruments with liquid

markets. The Company primarily executes derivative

transactions with major financial institutions.

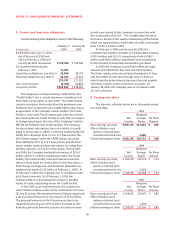

The following table summarizes activity in

Accumulated other comprehensive loss during 2005

related to derivative transactions used by the Company in

prior periods to hedge cash flow exposures relating to

certain debt transactions (in thousands):

Before-Tax Income After-Tax

Amount Tax Amount

Accumulated net losses

as of January 28, 2005 $ (1,539) $ 566 $ (973)

Net losses reclassified from

Other comprehensive

loss into earnings 286 (107) 179

Accumulated net losses

as of February 3, 2006 $ (1,253) $ 459 $ (794)