Dollar General 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

These notes contain references to the years 2006,

2005, 2004 and 2003, which represent fiscal years ending

or ended February 2, 2007, February 3, 2006, January 28,

2005 and January 30, 2004, respectively. Fiscal year 2006

will be, and each of 2004 and 2003 was, a 52-week

accounting period while 2005 was a 53-week accounting

period.The Company’s fiscal year ends on the Friday

closest to January 31. The consolidated financial state-

ments include all subsidiaries of the Company, except

for its not-for-profit subsidiary the assets and revenues

of which are not material. Intercompany transactions have

been eliminated.

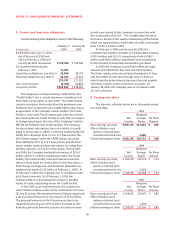

The Company leases four of its distribution centers

(“DCs”) from lessors, which meet the definition of a

Variable Interest Entity (“VIE”) as described by FASB

Interpretation No. 46,“Consolidation of Variable Interest

Entities”(“FIN 46”), as revised.Two of these DCs have been

recorded as financing obligations whereby the property

and equipment, along with the related lease obligations,

are reflected in the consolidated balance sheets. The other

two DCs, excluding the equipment, have been recorded as

operating leases in accordance with SFAS No. 98,

“Accounting for Leases.” The Company is not the primary

beneficiary of these VIEs and, accordingly, has not included

these entities in its consolidated financial statements.

Business description

The Company sells general merchandise on a

retail basis through 7,929 stores (as of February 3, 2006)

located primarily in the southern, southwestern,

midwestern and eastern United States. The Company has

DCs in Scottsville, Kentucky; Ardmore, Oklahoma; South

Boston, Virginia; Indianola, Mississippi; Fulton, Missouri;

Alachua, Florida; Zanesville, Ohio; and Jonesville, South

Carolina. The Company also has a DC under construction

in Marion, Indiana.

The Company purchases its merchandise from a wide

variety of suppliers. Approximately 11% of the Company’s

purchases in 2005 were made from Procter and Gamble.

No other supplier accounted for more than 3% of the

Company’s purchases in 2005.

Cash and cash equivalents

Cash and cash equivalents include highly liquid

investments with insignificant interest rate risk and

original maturities of three months or less when

purchased. Such investments primarily consist of money

market funds, certificates of deposit and commercial

paper. The carrying amounts of these items are a

reasonable estimate of their fair value due to the short

maturity of these investments.

Payments due from banks for third-party credit card,

debit card and electronic benefit transactions (“EBT”) clas-

sified as cash and cash equivalents totaled approximately

$7.8 million and $4.8 million at February 3, 2006 and

January 28, 2005, respectively.

The Company’s cash management system provides

for daily investment of available balances and the funding

of outstanding checks when presented for payment.

Outstanding but unpresented checks totaling approximately

$124.2 million and $112.3 million at February 3, 2006 and

January 28, 2005, respectively, have been included in Accounts

payable in the consolidated balance sheets. Upon presenta-

tion for payment, these checks are funded through available

cash balances or the Company’s existing credit facility.

The Company has certain cash and cash equivalents

balances that are subject to restrictions and are not avail-

able for general corporate purposes, as further described

below under “Investments in debt and equity securities.”

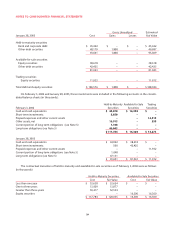

Investments in debt and equity securities

The Company accounts for its investment in debt and

marketable equity securities in accordance with Statement

of Financial Accounting Standards (“SFAS”) No. 115,

“Accounting for Certain Investments in Debt and Equity

Securities,” and accordingly, classifies them as held-to-

maturity, available-for-sale, or trading. Debt securities

categorized as held-to-maturity are stated at amortized

cost. Debt and equity securities categorized as available-

for-sale are stated at fair value, with any unrealized

gains and losses, net of deferred income taxes, reported

as a component of Accumulated other comprehensive

loss. Trading securities (primarily mutual funds held

pursuant to deferred compensation and supplemental

retirement plans, as further discussed in Note 8) are

stated at fair value, with changes in fair value recorded

in income as a component of Selling, general and

administrative (“SG&A”) expense.

In general, the Company invests excess cash in short-

er-dated, highly liquid investments such as money market

funds, certificates of deposit, and commercial paper.

Depending on the type of securities purchased (debt ver-

sus equity) as well as the Company’s intentions with

respect to the potential sale of such securities before their

stated maturity dates, such securities have been classified

as held-to-maturity or available-for-sale. Given the short

maturities of such investments (except for those securities

described in further detail below), the carrying amounts

approximate the fair values of such securities.